MAS keeps monetary policy unchanged in October

It expects Singapore’s growth momentum to remain weak in the near-term.

The Monetary Authority of Singapore (MAS) has kept it policy rate unchanged at its October review.

In an announcement on its website, MAS said it will maintain the zero percent per annum rate of appreciation of the policy band. The width of the policy band and the level at which it is centred will also remain unchanged.

The move comes as MAS expects underlying growth momentum to be weak whilst negative output gap to only narrow slightly in the year ahead. Furthermore, core inflation is expected to rise gradually and turn positive in 2021, although it will remain below its long-term average.

“As core inflation is expected to stay low, MAS assesses that an accommodative policy stance will remain appropriate for some time. This will complement fiscal policy efforts to mitigate the economic impact of COVID-19 and ensure price stability over the medium term,” the regulator said.

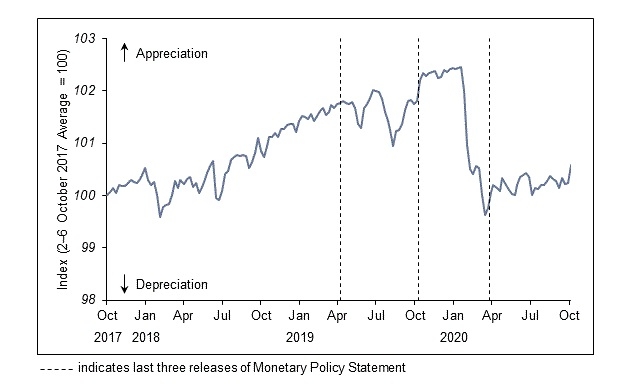

In its April 2020 Monetary Policy Statement (MPS), Singapore set the rate of appreciation of the S$NEER policy band at zero percent per annum, starting at the then-prevailing level of the S$NEER. There was no change to the width of the policy band.

The S$NEER had fallen sharply in Q1. Since the MPS on 30 March, it has hovered slightly above the mid-point of the new policy band. The relative stability of the S$NEER has reflected the strengthening of the S$ against the US$, offset by its weakening against a number of regional currencies.

Meanwhile, the three-month S$ SIBOR fell from 1% at end-March to 0.4% in early October, alongside the decline in the US$ LIBOR.

The Lion City’s GDP picked up in Q3 after its sharp contraction in the previous quarter. However, beyond the immediate rebound, GDP growth momentum is likely to remain modest, noted MAS, against a sluggish external backdrop, persistent weakness in some domestic services, and limited recovery in the travel-related sectors—comprising of air transport, accommodation and arts, entertainment and recreation industries.

“Nevertheless, barring a renewed worsening of the course of the COVID-19 pandemic, the Singapore economy is expected to expand in 2021, following the recession this year. Core inflation will remain low at 0–1% next year,” MAS said.

Advertise

Advertise