OCBC's nonperforming assets soar 34% to $2.59b

It was mostly driven by loans to oil and gas firms.

Oil and gas firms in Singapore continue to grapple with the slump in energy prices, signalling their expected difficulties in repaying their debts. In an interview with Bloomberg, OCBC CEO Samuel Tsien said the beleaguered sector is still far from recovering.

“I think the fourth quarter of this year will continue to be a difficult quarter for this sector," he said.

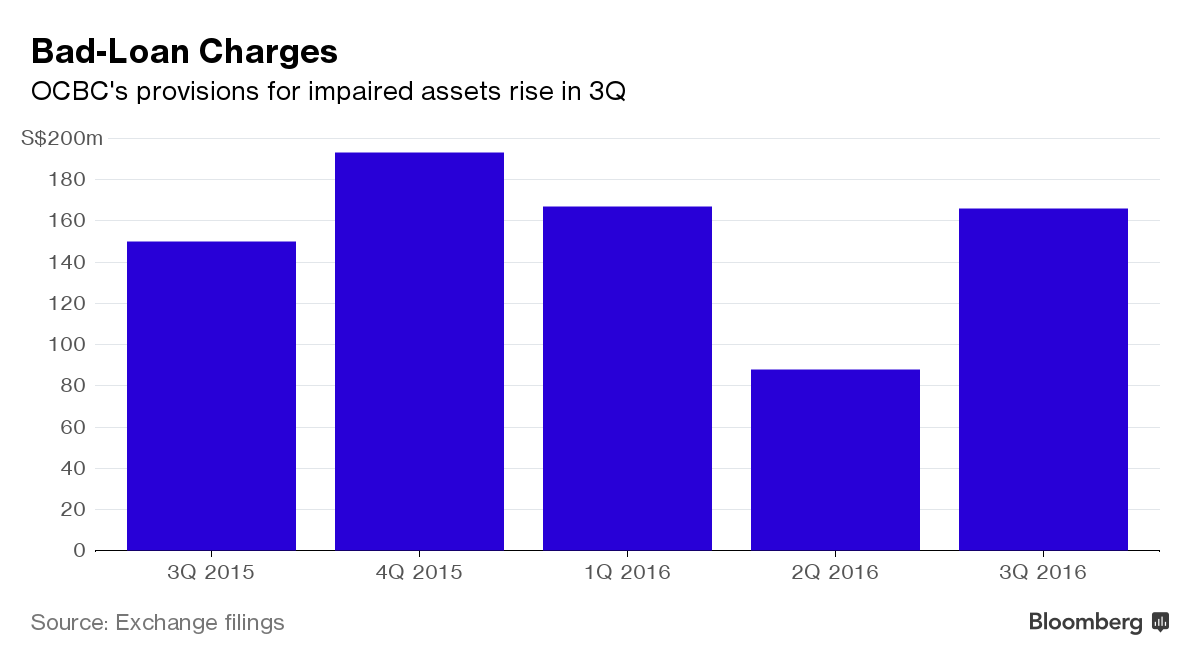

OCBC had earlier reported a 10 percent jump in provisions for soured assets for the third quarter, taking some of the gloss off the better-than-estimated profit the lender announced for the period. Its nonperforming assets surged 34% to $2.59 billion by September from a year earlier, driven by loans to oil and gas services firms that had soured, the bank said in a statement.

More Singaporean companies tied to that industry are facing difficulties repaying debt as demand for their services falls amid lower exploration activity. Swissco Holdings Ltd., which supplies rigs and support vessels to oil and gas explorers, signaled last week that it may face default, due to its failure to pay interest due earlier this month. Companies including KS Energy Ltd. and AusGroup Ltd. have sought more lenient repayment conditions from their debt holders.

OCBC’s allowances for impaired assets rose 10 percent to S$166 million in the third quarter. Oil and gas represented a third of the bank’s so-called specific allowances of S$99 million, Chief Financial Officer Darren Tan told reporters. Charges for soured oil and gas loans also dragged on OCBC’s earnings in the second quarter, when it reported a 15 percent profit decline.

Read more here.

Advertise

Advertise