Pandemic fails to dent Singapore fintechs' hiring plans: study

To cut costs, fintechs instead reduced office space or moved to smaller locations.

The pandemic has failed to slow the hiring plans of Singapore-based fintech firms, with majority indicating that they will expand their headcount in the coming months, a joint study by the Singapore FinTech Association (SFA) and PwC Singapore found.

Amongst the 1,491 surveyed individuals working at fintechs with a Singapore presence, 97% said that their company plans to hire more people in the next 12 months, according to the latest Fintech Talent Survey released. Meanwhile, for the 3% who said no, COVID-19 was cited as the main reason.

Instead, surveyed fintechs cut costs by reducing their office space or moving to a smaller location (36.4%) and reducing staff costs (33.3%). Meanwhile, 34.8% said that they did nothing to manage or reduce costs.

In terms of employment, fintechs in Singapore are increasingly hiring local talent, with more than one in four or 28.1% saying they plan to hire mostly local talents. Meanwhile, over three in five or 62.5% of respondents are still in favour of hiring a combination of both foreign and domestic talents.

The interest in local talent could be driven by enhanced capabilities of local talent as a result of numerous government upskilling initiatives, the study noted. Moreover, attracting and hiring foreign FinTech talent in a post-COVID environment could be quite challenging.

However, hiring local talent is not easy as most of them are attracted to larger and more established firms aside from their unrealistic salary expectations, SFA and PwC said.

Talent gaps also remained "manageable", with firms reporting no shortfalls or a shortfall of only up to 25% in their desired headcount—unchanged from the findings of the 2019 survey.

Many respondents indicated that candidates have no interest or knowledge on the fintech industry (23% highly applicable, 24% applicable) or lack of training at tertiary level in Singapore (30% highly applicable, 18% applicable) as the two biggest contributors to the talent gap in Singapore.

Other named drivers of the talent gap include candidates being the wrong fit for company culture (20% highly applicable, 20% applicable), difficulty in getting work permits for foreign staff (20% highly applicable, 14% applicable), and candidates preferring to work for incumbents (23% highly applicable, 15% applicable).

Offering higher salary packages, increasing the use of contract/ temporary/ freelance workers, increasing training for existing workers, and making it easier to obtain work permits for foreign workers, were some solutions to the talent gap suggested by fintech firms.

Pandemic boost

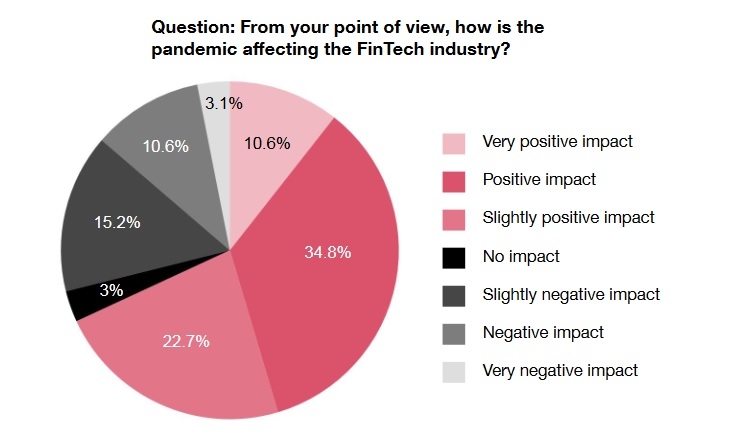

Despite its ill effects to the overall economy, respondents indicated that the COVID-19 pandemic brought some positive impact to Singapore’s fintech space. Amongst factors, talent attraction and retention, viability of existing projects and customer acquisition were named the most positively impacted areas for fintechs.

Conversely, profitability and cash flow were negatively impact due to the pandemic.

Per sector, the payments space was found to have received the biggest lift from the pandemic. Cybersecurity also reported a surge in business. The massive shift to e-commerce and the digital economy, combined with increased awareness around securing payments and other aspects of this digital surge, explains this outlook, the study said.

When it comes to boosting productivity, digitising business processes remained the largest stand-alone response, with over half or 57.6% indicating such. Just under 20% of respondents chose not to take any action to increase productivity.

Meanwhile, to increase revenue, fintechs shifted their focus to high-revenue products (50%), new businesses (43.9%), and entering new markets (42.4%).

Responses for “overall business growth” were noted as interesting by SFA and PwC as just over half reported some form of positive impact, and over one-third reported some form of negative impact, with only 10% stating there had been no impact. This result further reinforces the probability of a "K-shaped" recovery in Singapore’s fintech space, the report said.

Digital banks’ a ‘boon’ for talent pipeline

Majority of respondents viewed the imminent launch of digital banks in Singapore as a contributing factor to boosting the supply of local talent. Over half or 53% said that digital banks will have a very positive or positive impact to the supply of talents in the country.

“The imminent launch of digital banks in Singapore is largely perceived to be a boon for the talent pipeline, with the combination of banking and FinTech seen as offering the best of both worlds and driving interest in people to learn the necessary skills to work in such institutions. Such a result would likely have spill-over benefits to the wider FinTech community, increasing the availability of local talent across the industry,” the report noted.

However, almost one in 10 or 9.1% of respondents viewed digital banks to have a negative or very negative impact in the local talent supply.

Advertise

Advertise