Returns of CPFIS-included funds rose 0.18% in Q3

Positive returns of 0.47% were recorded amongst investment-linked insurance products.

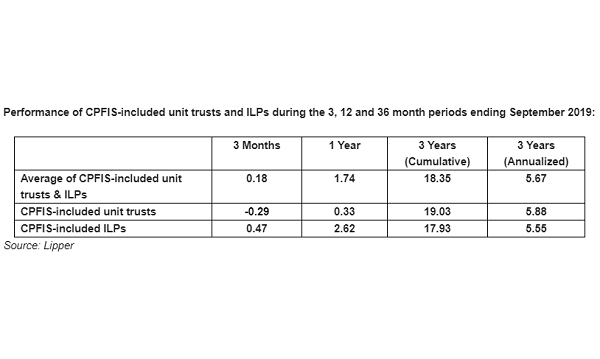

In the third quarter of 2019, the returns of the Central Provident Fund Investment Scheme (CPFIS)-included funds rose 0.18% on average, Refinitiv’s Lipper revealed. Specifically, a negative return of 0.29% and positive return of 0.47% were recorded amongst CPFIS-included unit trusts, and CPFIS-included investment-linked insurance products (ILP) respectively.

By asset class, across all CPFIS-included funds, except for equities, which posted negative return of 0.66%, bonds, mixed assets and money market funds achieved positive returns of 2.37%, 0.98% and 0.40% respectively. Meanwhile, MSCI World TR USD and FTSE WGBI Index rallied 2.89% and 3.08%, and MSCI AC Asia ex Japan posted negative return of 2.27%.

For the one-year period ended September 2019, the overall performance of CPFIS-included funds posted a slightly positive return of 1.74% on average. CPFIS-included unit trusts rose 0.33% on the year and CPFIS-included ILPs soared 2.62% on average.

Meanwhile, the key benchmark MSCI World TR USD and FTSE WGBI TR went up 3.66% and 9.44% respectively, whilst MSCI AC Asia ex Japan Index fell 1.98% for the period. On average, bond (+7.14%) fund outperformed the mixed-asset (+3.24%), money market (+1.46%) and equity (-0.13%) fund offering.

For the three-year period, CPFIS-included funds achieved 18.35% growth on average, accounted for a gain of 19.03% from CPFIS-included unit trusts and 17.93% from CPFIS-included ILPs on average. During this period, MSCI World TR USD and MSCI AC Asia ex Japan Index rallied 38.05% and 22.95%, respectively, whilst the FTSE WGBI TR achieved 5.09%. Equity type was the leading gainer (+22.33%) and bond portfolio posted positive return of 6.39%.

Advertise

Advertise