Singapore asset management industry defies global slowdown in 2018

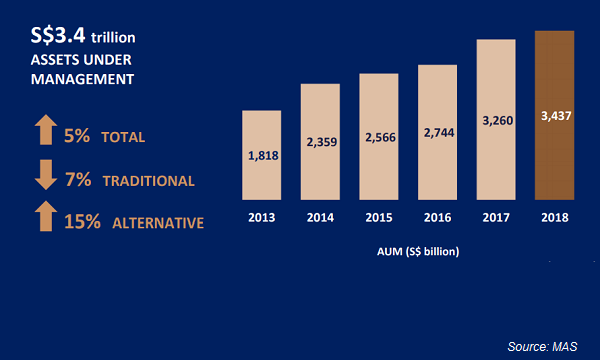

AUM rose 5.4% to $3.44t.

The asset management industry in Singapore weathered a global slowdown as assets under management (AUM) rose 5.4% to $3.4t (US$2.5t) in 2018, according to a release from the Monetary Authority of Singapore. The number of registered and licensed fund managers also rose by 72 to 787.

Of this figure, 75% of AUM were sourced from outside Singapore. 67% of total AUM was invested into Asia Pacific, of which more than a third were channeled into ASEAN.

Also read: Singapore could lure global wealth with passage of new VC bill

AUM growth was uneven across traditional and alternative asset management sectors. Traditional AUM fell 7% over the year amidst weak valuations across major asset markets. On the other hand, the alternatives sector posted 15% growth to $646b with the private equity (14%), venture capital (40%) and real estate (44%) classes seeing strong inflows and continued valuation gains.

“The medium term prospects for Singapore’s asset management industry remain favourable,” MAS said in the report. “AUM in Asia Pacific is expected to grow faster than any other region globally, almost doubling from 2017’s AUM to about US$30 t in 2025.”

Regulators embarked on several initiatives to enhance Singapore’s position as a full-service Asian hub for fund management and fund domiciliation including a programme that places up to US$5b for management with PE and infrastructure fund managers and a deal making platform that matches ASEAN enterprises to investors.

The Variable Capital Companies Act 2018 was also passed in October 2018 which introduces a flexible corporate structure for investment funds that complements the existing suite of fund structuring options in Singapore.

Global AUM fell 4% to US$75t in 2018, reversing a 12% increase in 2017.

MAS conducts an annual survey of the Singapore asset management industry with 827 respondents participating in the 2018 survey.

Advertise

Advertise