Singapore equity proceeds skyrocket 145.8% to US$2.3b in Q1

Follow-on offerings, which soared 579.2% offset weakening IPO proceeds.

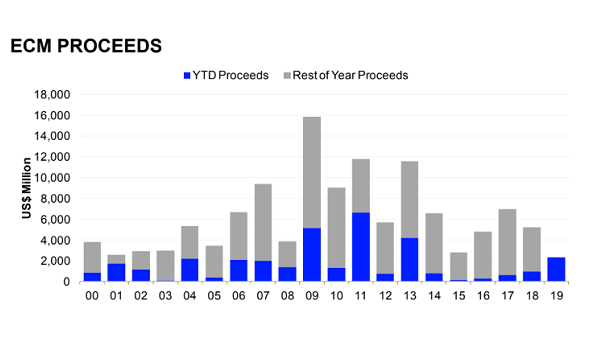

Singaporean equity and equity-linked (ECM) proceeds in Q1 skyrocketed 145.8% YoY to US$2.3b to mark the strongest start to the year in terms of proceeds since 2013, according to data from Refinitiv.

The strong quarterly gains were driven by the US$1.5b American depository share follow-on offering from game developer Sea Ltd in New York which represents the biggest equity offering from a Singaporean company so far in 2019. The follow-on offerings of Keppel Infrastructure Trust, Wave Life Sciences, Mapletree Industrial Trust and Cromwell European REIT also made it to the top ECM deals for the quarter.

As a whole, the Q1 proceeds from follow-on offerings soared by a whopping 579.2% YoY to US$2.2b which more than offset sluggish IPO proceeds which plunged 79.5% YoY to US$75.6m.

Also read: Singapore IPO proceeds plunge to $730m in 2018

In the ECM underwriting league, Morgan Stanley and Goldman Sachs are tied for first place with a 34.2% market share and US$776.3m in related proceeds. DBS Group Holdings is in third place with US$203.7m in proceeds and 9.0% market share folowed by UBS with a US$85m haul.

Advertise

Advertise