Singapore's private banks hold steady amidst industry rout

The AUM of Bank of Singapore rose 3% to US$102b.

The private banking businesses of Singapore’s biggest banks weathered the broad-based industry decline as assets under management either held steady or fell marginally in 2018, according to a report from Asian Private Banker.

Also read: Singapore's wealth management business dominates Asian competition

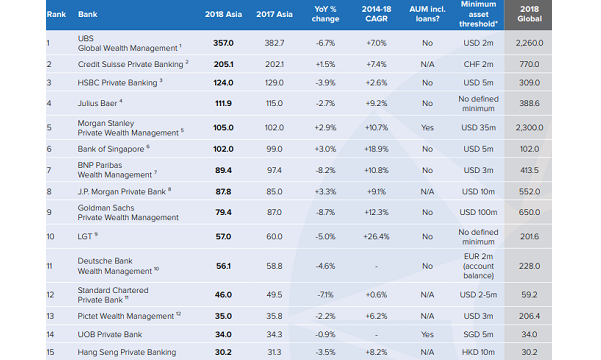

The AUM of Bank of Singapore, OCBC’s private banking arm, rose 3% YoY to US$102b in 2018 which puts it at sixth place in the regional AUM league and trailing behind big US wealth managers. Similarly, assets managed by UOB Private Bank dipped marginally by 0.9% to US$34b over the same period which puts the bank at fifteenth place.

On the other hand, the AUM of DBS whose wealth management business includes DBS Treasures, DBS Treasures Private Client and DBS Private Bank, rose 7% YoY to an aggregate figure of US$161.5b. Given the intermingling of private and non-private banking segments, DBS was omitted from the regional rankings.

Swiss-based UBS dominates the Asian leaderboard even as AUM fell 6.7% to US$357b and made the bank unable to cross the US$400b mark. Credit Suisse follows at second place with US$205.1b AUM. HSBC, Julius Baer and Morgan Stanley round out the top four with US$124b, US$111.0b and US$105b in AUM respectively.

Overall, the AUM of top 20 private banks in Asia fell 3.6% to US$1.63t in 2018 although Asia-headquartered banks fared marginally better than internationally-headquartered counterparts (-3.4% vs -3.7%).

“Banks entered the new year on the front foot, generally urging clients to stay invested and hedge amidst bouts of volatility and whilst their advice did not fall on deaf ears, clients exercised extreme caution by reining in trading activity, deleveraging, and upping cash holdings which sustained throughout the year,” Asian Private Banker said in a statement.

Advertise

Advertise