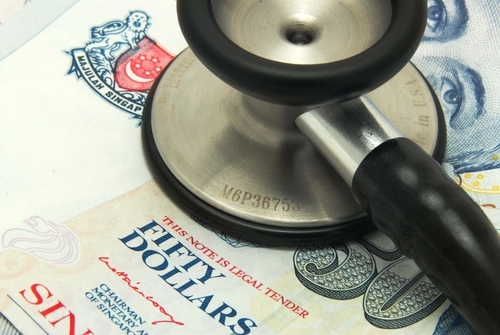

How the heightened currency volatility has impacted healthcare REITs

Were they badly hurt?

According to OCBC, although there has been heightened volatility in the IDR and JPY vis-à-vis the SGD in recent months, this has minimal impact on healthcare REITs.

For FREIT, the base rental for its Indonesian properties is denominated in SGD, while the variable rental component is pegged to a fixed SGD/IDR rate throughout the entire lease tenure.

Here's more from OCBC:

Although PLREIT’s 1H13 revenue fell 1.2% due to a weaker JPY, DPU still grew 4.5% as management had extended its JPY denominated net income forward hedge in 1Q12 for another five years until 1Q17. It also adopts a natural hedge strategy for its operations in Japan.

Both healthcare REITs are cognisant of the negative impact that would result from a rising interest rate environment. Approximately 75% of PLREIT’s borrowings have been hedged as fixed rate debt.

For FREIT, although 72% of its debt is based on a floating rate structure, management is in the process of finalising the refinancing of ~S$92m of its floating-rate debt to a 4-year fixed-rate unsecured bank loan. This would lower its floating rate exposure to ~46% upon completion.

Advertise

Advertise