Singapore's top healthcare stocks average 5% YTD dividend yield

This outpaces STI's 12M yield of 4%.

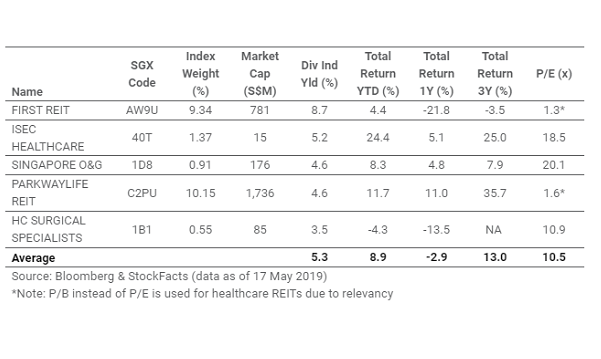

Singapore's top healthcare stocks averaged a dividend indicated yield of 5.3% YTD to outpace the of the benchmark STI 12M yield of about 4%, according to SGX.

Also read: Here's why Singapore's healthtech landscape looks promising

First REIT leads the pack with an average dividend yield of 8.7% followed by ISEC Healthcare (5.2%). Singapore O&G and Parkway Life REIT both have a dividend yield of 4.6% and HC Surgical Specialists rounds out the top five with 3.5% dividend yield.

Healthcare was also amongst the top net buy sectors on SGX in April with net institutional inflows of $2.83m (S$3.9m), up from net inflows of $1.52m (S$2.1m) in March, according to SGX data.

The iEdge SG All Healthcare Index has 34 constituents with a combined market capitalisation of nearly $25.38b (S$35b).

Advertise

Advertise