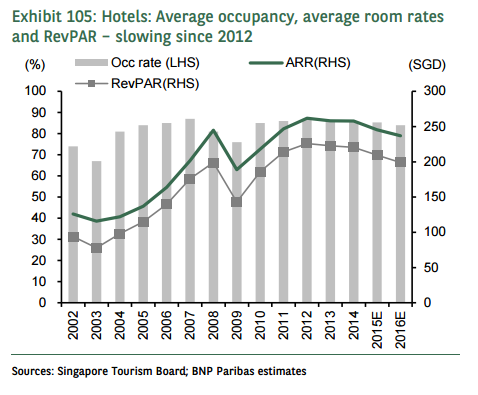

Chart of the Day: Hoteliers forced to slash rates as occupancy tumbles

Economy players are hardest hit.

Hotels in Singapore are grappling with lower room rates and softer occupancy despite an uptick in tourist arrivals.

This chart from BNP Paribas shows that average room rates are expected to drop in Singapore this year, extending an unabated downtrend since 2012.

BNP Paribas noted that although the number of tourist arrivals has recovered in 2015, rising hotel room supply will continue to adversely impact the sector this year.

"It remains to be seen how the demand recovery could absorb the upcoming pipeline of 7,309 new hotel rooms [from 2016 to 2018]. e, in 2016, about 17 new hotels are to open in total, working out to about 3,930 rooms. The large inventory may put pressure on hotels’ occupancy rates, especially for the mid-scale and economy markets," BNP Paribas noted.

Apart from the massive supply of rooms, hoteliers will also grapple with weak leisure and corporate spending, as well as shorter stays by visitors.

“Overall, we find hotel landlords are seeking a balance between occupancy and room rates, to optimize their earnings potential,” said the report.

Advertise

Advertise