Hotel room supply to increase 1.2% in 2018

Upscale and Mid-Tier hotels clocked a +0.1% revenue per available room (RevPAR) increase in 2017.

Are Singapore hotels finally having their own holidays? The 1.5% decline in Singapore hotels’ revenue per available room (RevPAR) in 2017 is softer compared to 4.7% and 5.3% dips for the whole of 2016 and 2015, respectively. Meanwhile, average occupancy rate grew 1.5 ppt and average room rate grew fell 3.3%.

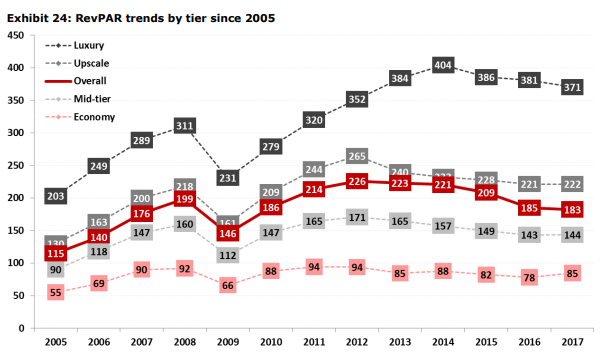

OCBC Investment Research analyst Deborah Ong noted that the RevPAR increase to was most significant for the Economy hotels in 2017 (+8.4% YoY). “2017 RevPAR for luxury hotels fell 2.8% YoY, whilst Upscale and Mid-Tier hotels clocked a +0.1% increase YoY,” she added.

Moreover, an upswing is expected for the supply side of hotels. “The total room stock is expected to increase 1.2% in 2018, which in our opinion, will likely be less than the increase in visitor days this year. Should both leisure and corporate demand remain healthy, the relatively muted room pipeline from 2018F to 2020F should put the Singapore hospitality market in a position for a multi-year upswing,” Ong added.

The current oversupply of hotel rooms in Singapore is likely to temper growth, however, consumer confidence is likely to strengthen, as Singapore is expected to firmly remain the leading Asian destinations of choice in 2018. This was reflected in Colliers International forecasts that the average daily rate (ADR) of Singapore's hotels is expected to climb by 1-3%.

OCBC Investment Research also revealed that corporate demand has picked up perceptibly in terms of volume, with more requests for proposals and corporate enquiries for function rooms and activities recorded. “We see this as a positive both for REITs with hotels assets catering to businesses, as well as serviced residences, which have had a difficult 2018. Meanwhile, we expect leisure demand to remain healthy, and forecast a mid-single digit growth in visitor days,” the firm said.

The key data points for 2017 were the 4.5% increase in room supply and the 4.6% increase in visitor days (on the back of a 6.2% increase in tourist arrivals), and 3.6% increase in Singapore GDP.

Ong projected growth for the figures and said, “RevPARs are expected to improve in 2018 with better supply-demand dynamics, though we expect slightly weaker RevPAR/RevPAUs growth (low single-digit) for 1Q2018 given the back-end loaded supply injection in 2017. For 2018, key data to note are the 1.2% projected increase in hotel room supply, their expected mid-single digit growth in visitor days, and the official forecast of 1.5% to 3.5% growth in Singapore GDP.”

Advertise

Advertise