Hopes fading for the manufacturing sector

Pessimism lingers even as tech backlog orders rose 3.7 pts to 50.8.

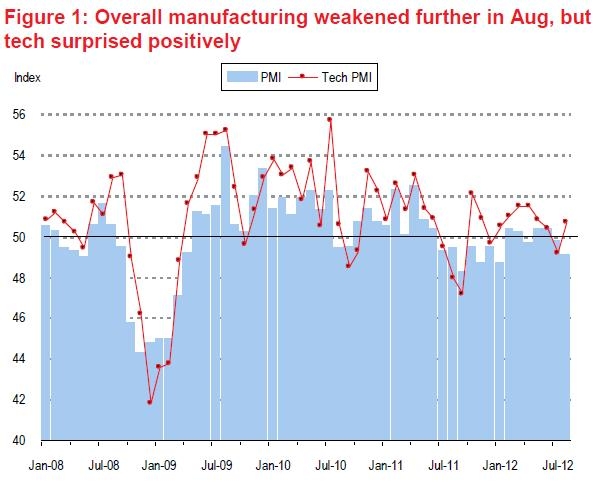

Manufacturing output, as measured by the monthly PMI, fell another 0.7 pt (-0.6 pt in July) to 49.1 last month. A mild expansion in output, +0.5 pt to 50.3, was offset by lower overall orders (-1.5 pts), inventory (-1 pt), imports (-1.4 pts) and employment (-1.4 pts).

According to CIMB, if there is any silver lining, it is that new export orders rose 0.2 pt (-0.9 pt in Jul) to 50.4 and backlog orders jumped 3 pts to 51.5, the first expansion in over a year.

Furthermore, despite stronger production amid weaker orders, finished goods inventories did not rise, dipping another 1.2 pts instead. The latter may drive stronger output in Sep.

Here's more from CIMB

Tech’s back in expansion

While overall manufacturing activities contracted further in Aug, it is encouraging to see tech back in expansion mode last month on the back of stronger export orders and output. After two consecutive months of decline, export orders rose 3.6 pts to 52.4 while output jumped 7.1 pts to a 2-year high of 56.3 (this is not a typo!). And with tech backlog orders rising 3.7 pts to 50.8, the near-term outlook for Singapore’s tech sector has suddenly taken a positive turn. While global macro conditions remain subdued, lean inventories will help

keep production stable.

While the poor PMI readings for the last two months (including those from key manufacturing countries including China, Japan, Korea and Taiwan) do not augur well for Singapore’s manufacturing, the latest tech PMI reading (tech accounts for about 33% weight of total manufacturing value-added) gives some hope that tech may finally contribute rather than remain a drag on overall manufacturing in 3Q12. Over the Jan-July period this year, tech subtracted 4.5% pts from overall manufacturing growth of 1.9% yoy. Fortunately, biomed manufacturing and transport engineering added 3.5% pts and 3% pts, respectively, to offset the tech drag. However, the poor overall PMI readings for the last two months suggest that the lift from non-tech manufacturing may be weakening in the face of increased global headwinds.

Furthermore, sentiments in Singapore’s service-producing sector have been affected via trade and financial linkages. Service sector growth contracted 0.6% qoq on a SAAR basis due to weaker trade-related services while some business and hospitality-related services also struggled. Therefore, Singapore’s 2H12 growth may undershoot our current 4-4.2% forecast (1H12: 1.7%).

Advertise

Advertise