Singapore

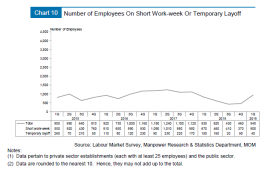

Chart of the Day: Employees on short work-week more than doubled to 900 in Q1

Four in five were from the manufacturing sector. This chart from the Ministry of Manpower (MoM) shows that employees on short work-week more than doubled (143%) MoM to 900 in Q1 2019 from 370 in Q4 2018.

Retrenchments grew to 3,230 in Q1 over manufacturing cutbacks

High costs and industry downturn prompted more retrenchments.

Why Digital Workers will be needed in the Future of Work

Machines and humans working side-by-side will be the new normal at the workplace for improved worker productivity and job satisfaction.

Civil servants to receive 0.45 month mid-year bonus in July

Around 1,400 civil servants will also benefit from a higher one-off lump sum payment.

Here's why ThaiBev's turnaround may already be in the works

A rebound in beer consumption and retail sales bodes well for the second largest Thai beer player.

How can CapitaLand Retail China Trust fund its $589.2m mall acquisition?

A private placement paired with preferential offering could boost its DPU, an analyst said.

SATS eyes over $1b in capex and investments from FY20-22

This means that SATS may shell out $333m annually on average during the three-year period.

Faster immigration clearance for British travellers in Singapore launched

Enrolment for the Frequent Traveller Programme is free.

STB and Tiger Beer pledge $3.2m in campaign to promote Singapore

The two-year partnership will see STB bring to life four Tiger District Bottle through AR technology.

Singtel unit unveils EUR500m fixed rate notes due 2029 at 1%

Singtel Optus will utilise the funds for general corporate purposes. Singtel subsidiary Singtel Optus priced its EUR500m ($770.82m) 10 year fixed-rate notes at 1% per annum and for maturity on 20 June 2029, an announcement revealed. Under the Optus Finance EUR3b ($4.62b), the issued notes are guaranteed by Optus and certain subsidiaries. “This issue is part of Optus’ long-term financing strategy, extends the maturity profile of Optus’ debt as well as adding diversity to its debt structure,” Singtel said in a filing, noting that Optus will utilise the funds for general corporate purposes. Citigroup Global Markets, HSBC Bank and Merrill Lynch International acted as joint lead managers and bookrunners for the notes which will be issued on 20 June.

Singapore's healthcare expenditure to hit US$24.6b by 2020

Private healthcare allowances are tipped to grow at a 8.3% CAGR between 2016-2020.

Three lessons for ASEAN's Smart Cities Network

To mark the end of Singapore’s ASEAN chairmanship in November 2018, Prime Minister Lee handed Thailand’s Prime Minister, Prayut Chan-o-cha, a wooden gavel and the Thai premier thanked Singapore for "efficiently driving forward a resilient and innovative ASEAN community". So what can the community learn from Singapore after a decade?

IPOS rolls out insurance for intellectual property rights holders

It aims to cover legal expenses incurred in IP infringement proceedings worldwide.

Hyperpersonalisation— the holy grail of retail

The retail sales (excluding auto) in Singapore has been declining since 2014 on an average of 0.2% per year, but the yearly decline is much faster in departmental stores and apparels at 0.7% and 0.4% respectively. This decline in retail spending is despite the household incomes going up by 12% during the same period. Clearly, the malls and stores need to have a paradigm shift in shopping experience to be able to reverse the declining trend and give a solid reason for shoppers to spend more in stores.

Singapore climbs eight spots in costliest expat city rankings

It ranked 12th due to another strong year for the Singapore dollar.

Pioneer and Merdeka Generation seniors to get $270m of MediSave top-ups in July

The top-ups will be given only to qualified seniors.

Advertise

Advertise