Singapore

SGX RegCo to roll out measures to further support issuers

These include the suspension of the half-yearly reviews in June and December.

SGX RegCo to roll out measures to further support issuers

These include the suspension of the half-yearly reviews in June and December.

Grade A CBD fell to $10.61 psf/month in Q1 2020

Overall GDP also contracted at -2.2% whilst service industries declined at -3.1%.

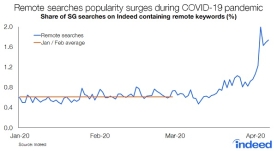

Remote work search surge by 183%

Job seekers show more interest in working from home amidst social distancing measures.

Yangzijiang Shipbuilding appoints new executive chairman

Ren Letian will succeed his father Ren Yuanlin. Yangzijiang Shipbuilding's (YZJ Shipbuilding) executive chairman Ren Yuanlin has stepped down to pursue other career opportunities, according to an announcement. His designation will be filled by his son and YZJ Shipbuilding’s CEO Ren Letian. The shipbuilding company has also announced the appointment of deputy general manager Song Shu Ming as an executive director and Toe Teow Heng as an independent non-executive director. Ren Yuanlin holds a 21.69% stake in the company, comprising 0.08% of direct interest and 21.61% of indirect interest through Yangzi International Holdings Limited.

AMTD Group unit now listed in SGX

It brings the total number of secondary listings on the bourse to 30.

European IPP Amarenco sets up APAC HQ in Singapore

It is starting with the acquisition of a 50MW portfolio in Thailand.

SPH's profit dropped 9.3% to $77.64m in H1

Revenue from its media business slipped 14.3% due to smaller media ad sales.

CBD Grade A rents up 4.7% in Q1

Capital value and rates also remained unchanged in Q1 2020. CBD grade A office rents rose 4.7% YoY to $10.09 per sqft per month (psf pm) in Q1 as the negative impact of the COVID-19 pandemic will continue in Q2, according to a Colliers report. On a QoQ basis, grade A office rents remained unchanged.

Chart of the Day: Online grocery sales hit over $600m in February

It is tipped to steadily rise as most Singaporeans are encouraged to stay home.

Daily Briefing: Restaurant owners halt operations during ‘circuit breaker' measures; Quest Ventures gets Pavilion Capital, QazTech as anchor LPs

And grounded aircrew enlisted for virus prevention service.

Daily Markets Briefing: STI up 4.1%

CapitaLand led the gains amongst top active stocks soaring by 8.39%.

UOB to shut down 24 branches

Thirty-eight will remain open, each located within a 3km radius from a closed branch.

MAS alters regulatory requirements for COVID-hit banks

Banks can now adjust their capital buffers to support lending activities.

SGX RegCo grants automatic 60-day extension for issuers to hold AGMs

This follows after the regulator gave a two-month extension for AGMs last February.

ESG, ecommerce giants roll out Singapore E-Commerce Programme

The initiative will provide 90% support to retailers in domestic markets.

Grab slashes half of driver commissions until 4 May

Additional schemes to be implemented during the circuit-breaker timeframe. Grab is reducing its commission rate for private-hire drivers by 50%, according to an announcement. Meanwhile, drivers renting cars from Grab's vehicle rental arm will get an additional 50% commission reduction, meaning they will not need to pay any commission to the company. The reduction will be implemented until 4 May as ride demand has gone down due to circuit-breaker measures. Grab also lowered the qualifying criteria for weekly cover, which gives eligible drivers income support depending on their tier. Free weekly cancellations will also be reduced from six to three cancellations per week. Meanwhile, GrabRental drivers will receive a 30% rental waiver of up to $20 a day during the circuit-breaker timeframe, and may defer 20% of their rental costs of up to $14 a day for the next six months. The programme is part of Grab's contribution to the government’s $73m special relief fund to help private-hire and taxi drivers affected by the coronavirus outbreak.

Food demand to shift to groceries, residential outlets and online delivery platforms

Outlets dedicated to dine-in customers will face challenges.

Advertise

Advertise