Teppei Takeda, Painting of Painting 026 (L); Yoshitomo Nara, O.T (N.G) [Photo from Phillips]

Teppei Takeda, Painting of Painting 026 (L); Yoshitomo Nara, O.T (N.G) [Photo from Phillips]

Asian collectors embrace newer artists, contemporary art to diversify collections

Japan’s Teppei Takeda and China’s Sun Yitian are amongst the emerging names in Asia.

Younger and fresher names are gaining prominence in the art scene as Asian collectors brush past their comfort zones, shifting their gaze from Western values to a wider spectrum of artists and themes.

Francis Belin, president of Christie’s Asia Pacific, said the desire to diversify collections with works by emerging contemporary artists is amongst the motivations for their Asian buyers when purchasing art.

Auction house Phillips also observed this trend as some of the top performing lots in its Spring sales were works by younger Asian artists such as Teppei Takeda of Japan and Cui Jie, Sun Yitian, and Xia Yu of China.

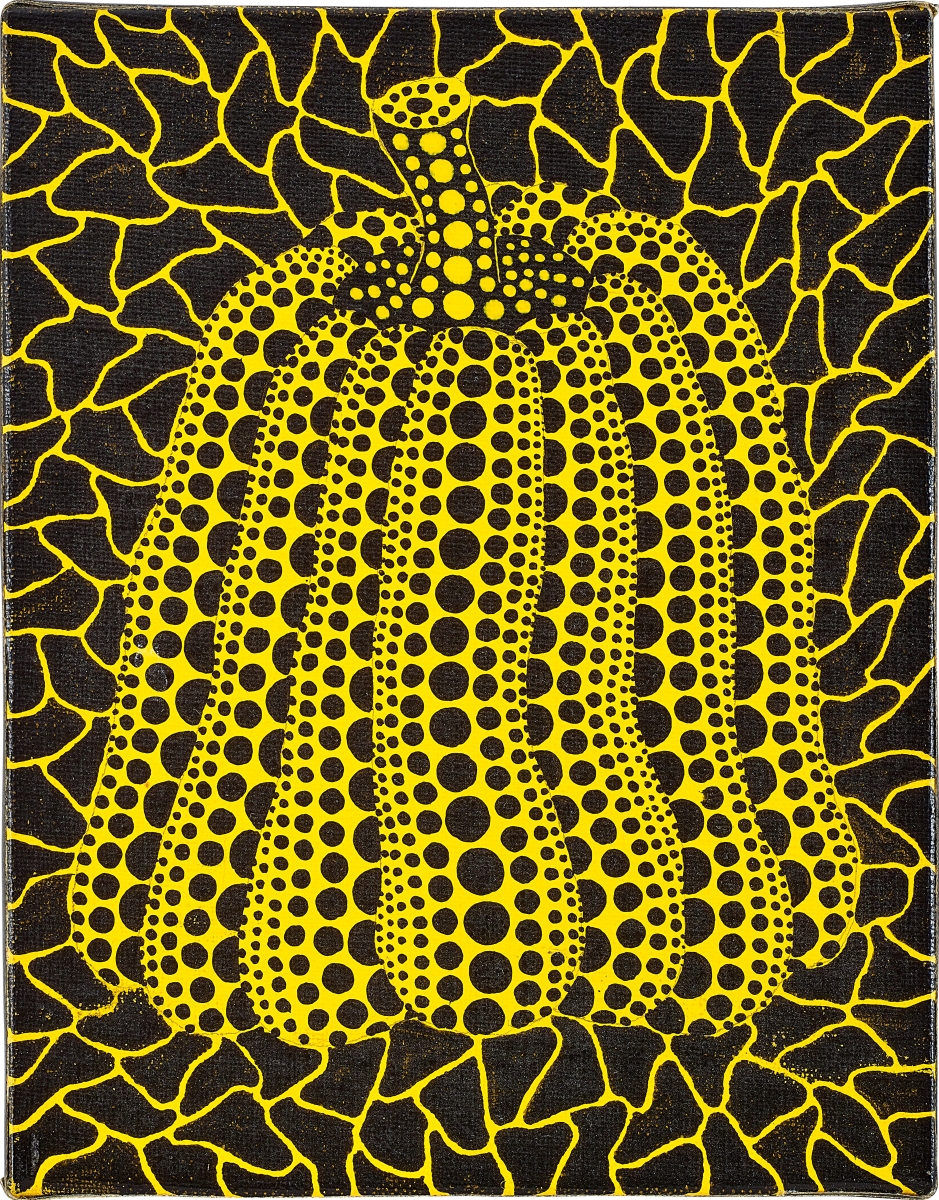

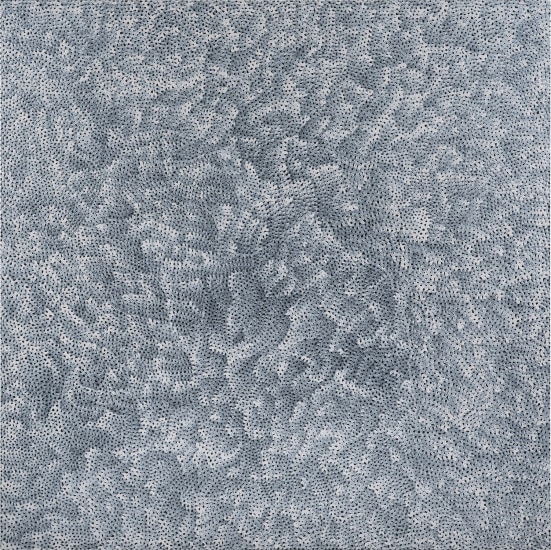

Takeda’s “Painting of Painting 026” fetched US$235,528 (HK$1.84m) during Phillips’ Evening Sale on 31 May, more than six times its pre-sale high estimate.

The art piece “set the second highest price for the artist at auction,” said Meiling Lee, head of Modern and Contemporary Art in Asia at Phillips.

In the same evening sale, Sun Yitian, often referred to as China’s “It” artist, achieved her second highest price with the sale of “A Tender Panther” at US$211,163 (HK$1.65m).

This year, Phillips made sure to put a spotlight on younger artists. “In our Spring auctions in Hong Kong, we also offered a selection of Chinese contemporary works produced by artists born in the 1960s to 1990s, including Zhang Enli, Ding Yi, Huang Yuxing, Liu Wei, Chen Ke, Xia Yu, Cui Jie, Sun Yitian, Zhang Zipiao, and more,” Lee said.

With works of younger artists, particularly those of Asian descent, deservedly hugging the limelight, Phillips has increased their share in Hong Kong Sales.

In addition to showcasing emerging talent, Phillips has also spiced up the mix of Asian artists. There were Contemporary and Modern artists from China, Japan, Korea and Southeast Asia in its inaugural New Now auction launched in Hong Kong last November. In July,

Phillips will be presenting a selling exhibition featuring works from two young female Chinese artists.

“This season, we presented a selection of works by the Japanese Gutai group, the country’s first post-war radical art movement,” Lee added.

Emerging and established

Being “in with the new” doesn't mean “out with the old” for Asian buyers. According to Jasmine Prasetio, managing director, of Southeast Asia at Sotheby’s, collectors in Asia have been “extensively collecting art both old and new, established and emerging, from the East and the West.”

Amongst the established names in Asia, Yayoi Kusama and Yoshitomo Nara are standouts. Prasetio said these two Japanese artists “have always had a firm representation and patronage internationally.

“With the growing collector base and demand, more and more collectors look for iconic works by these artists,” said the Sotheby’s expert.

In Sotheby’s Spring Sales, Nara’s “I Want to See the Bright Lights Tonight” fetched US$12.3m (HK$96m/ SG$16.5m).

Meanwhile, Kasuma’s INFINITY NETS (ZGHEB) from 2007 realised US$3.3m (HK$26m/SG$4.4m) in Phillips’ Modern & Contemporary Art auction held in May.

“Iconic paintings by Nara and Kusama featured in the Day Sale all sold above their pre-sale estimates,” added Lee.

Work by Yayoi Kusama took up approximately 26% of the market share in Phillips’ Modern & Contemporary Art auctions in Hong Kong this Spring.

Christie’s likewise felt the demand for Nara and Kusama’s artworks, saying their Asian Contemporary pieces “all had solid performances.”

Contemporary, Modern, and Impressionist

There has been consistent interest in Asia on Contemporary, Modern, and Impressionist works of art, according to Prasetio.

Phillips saw this interest in its Spring Modern & Contemporary Art Hong Kong Sales which fetched US$38m (HK$296m/SG$51m) total, a 22% increase from its Fall 2023 sale.

Top lots in the season included Native Carrying Some Guns, Bibles, Amorites on Safari by Basquiat sold for US$12.6m (HK$99m/SG$17m); Banksy’s The Leopard and Lamb, which sold for US$4.7m (HK$36.8m/SG$6m) or double the pre-sale estimate; and Zao Wou-Ki’s 25.11.81 which sold for 1.7 times its pre-sale estimate at US$1.5m (HK$12m/SG$2m).

“All these top lots were fresh-to-the-market,” Lee noted.

At Sotheby’s, Asian interest in Impressionist and Modern works of art increased, accounting for 18% of bidders in the first half of 2023, up from 13.8% in 2022.

For Christie’s, works by Marc Chagall and the Impressionist line-up in the Evening Sale at its Hong Kong Spring Auctions 2024 were also 100% sold, whilst Chinese Modern works by Zao Wou-Ki, Sanyu, and Chen Yifei had a solid performance.

Asian art

Asian art, including Chinese ceramics works of art and paintings, has also been popular, especially amongst Southeast Asian buyers. Christie’s reported that the number of buyers from Southeast Asia in the Asian Art cluster rose by more than 40% this Spring versus 2023.

As a fine example of Asian art’s popularity, Christie’s sold Qing Imperial Ceramics from The Wang Xing Lou Collection for US$15.8m (HK$123m/SG$21m).

Christie’s also sold its multiple entire single-owner Chinese Paintings collections which included Property from the Collection of Dr. Wong Chun Bong, and the Family Collections of Chong Fung Kuen, K’ung Hsiang-Hsi, Loh Cheng Chuan, and the Kwok Family.

Asian art also resonates with the “new, tech-savvy, younger generation” of buyers, said Belin.

According to Christie’s, almost a quarter of all its Asian art buyers were millennials, whilst 21% were new.

In Singapore, there has been significant interest in art pieces with Peranakan heritage, according to Matthew Elton, founder and manager of Hotlotz, one of the country’s leading auctioneers.

“Peranakan porcelain, beadwork, and silver have been really popular [in our sales]. I think there’s a real interest in the culture and heritage of Singapore and Peranakan culture is very Singaporean,” said Elton.

Young buyers

Across all art categories, auction houses have observed a strong interest in art from young collectors.

Elton, who founded and manages Hotlotz, one of Singapore’s foremost auctioneers, noted that he has encountered buyers from a wide age range.

“There is often a misconception about auctions, that all collectors are in their more ‘advanced years’, but actually we are seeing a very broad age range amongst our bidders,” Elton told the magazine.

To appeal to this demographic Hotlotz conducts a monthly “entry-level” “Interiors” sale where they auction off quality furniture, decorative items and collectibles every first Sunday of the month.

“We’re definitely finding that younger people are also coming at auctions with a more sustainability hat on as well, whereas 20 or 30 years ago, they thought everything had to be brand new in their homes, but now they’re really interested in looking for that cool vintage piece or that secondary market picture,” Elton said.

In Christie’s Hong Kong 2024 Spring Auctions, almost a quarter of their buyers were new; and amongst them, 43% are millennials. In 2023, Christie’s also saw growth in new and younger buyer spend, led by Asia-Pacific.

According to Christie’s, Asia-Pacific buyers accounted for 66% of its global millennial buyer spend and 54% of its global new buyer spend. Meanwhile, millennials drove 35% of APAC’s new buyer spend.

Within Asia-Pacific, Mainland China was the biggest contributor to Christie’s global new buyer spend (30%) and millennial buyer spend (36%).

At Sotheby’s Hong Kong Spring Sales in April this year, millennials or those aged 40 and below accounted for over half (55%) of all bidders across its sales.

Prasetio said Sotheby’s saw stronger participation from Gen Z and millennial bidders in sales of wine (36%), Chinese works of art (29%), and jewellery (28%).

Christie’s also observed this trend, with millennials constituting 52% of their new buyers in the luxury art segment which includes wine and jewellery, as well as watches and handbags.

At their Hong Kong Spring Auctions 2024, Christie’s sold a “Cartier ‘India’ Tutti-Frutti” necklace for US$8.72 (HK$67.80m/SG$11.75m), and a superb ruby and diamond ring for US$6.43 (HK$49.99m/SG$8.67m).

Meanwhile, “The Epic Cellar,” a single-owner collection of wine, was 96% sold by lot and fetched US$8.6m (HK$67m/SG$11.60m).

For younger buyers who are only setting foot on the art scene and do not have a lot of budget, Lee said prints and multiples can be a good place to start collecting fine art.

Phillips offers prints and multiples which they call “Editions,” which are more affordable than unique paints and sculptures “but usually require highly complicated techniques with a master printer to create an edition,” said Lee.

Going digital

To further engage the new, younger, and tech-savvy generation of collectors, Belin underscored the need for digital evolution.

Amongst the auction house’s digital investments include “Christie’s Live,” and “Christie’s WeChat mini-programme” which are specifically for biddings.

“We were the first international auction house to launch a WeChat mini-programme with online bidding and livestreaming functions – which are essential for connecting with young, tech-savvy Chinese collectors,” Belin said.

“We continue to innovate on the platform and recently introduced AI translation, to make content such as sales information and condition reports available in Chinese,” he added.

Christie’s also utilises platforms such as Instagram, RED, a Chinese social media platform, and Douyin, a platform for short-form videos like TikTok, to present and showcase their auctions.

Hotlotz is also a leader in digitalisation amongst auction houses in Singapore, conducting all their bidding online even before the pandemic.

“We made a decision six months before the onset of the COVID virus was discovered to go online only because we felt that it’s actually a safer and more practical environment for bidding to take place,” Elton said.

“I personally think that auctions are all about building trust, if people trust us, they happily bid on all types of items,” Elton added.

The Hotlotz founder also highlighted that online bidding systems are great from a marketing perspective as this allows the auction house to use technology to reach a global audience.

“We recently sold a collection of Chinese & Southeast Asian Trade Porcelain for Aman Resorts Founder, Adrian Zecha, and the majority of the pieces ‘went home’ as they were snapped up by online bidders from China and Vietnam,” Elton said.

Infrastructure

Besides enhancing their digital footprint, the world’s leading auction houses are also broadening their physical reach.

Sotheby’s, for one, has a new 24,000-square-foot space in Central, Hong Kong, called “Hong Kong Maison." Through the Hong Kong Maison, Sotheby’s aims to host exhibitions and auctions all year round.

“The accessibility and visibility of this space will provide an unparalleled platform for our showcase and curation,” Prasetio said.

In September, Christie’s will move its Asia-Pacific headquarters to The Henderson in Hong Kong in order to “to support our growth for art and luxury” in the region, Belin said. “The decision to relocate comes in response to Asia’s global market demand.”

Christie’s will occupy 50,000 square feet spanning the 6th to 9th floors of The Henderson.

The auction house will host its inaugural sales at The Henderson on 26-27 September for 20th and 21st Century Art, followed by a series of Luxury sales in October and Asian Art sales in November, kick-starting a new year-round calendar.

In March 2023, Phillips opened its new Asia headquarters in West Kowloon.

Given that the three major auction houses will have permanent spaces in Hong Kong, Lee expects the art market in the region will become “more mature.”

“We have also seen ambitious new homegrown fairs launched in Asia as well, although these efforts will pay off remain to be seen but it’s good to see the whole ecosystem in the region is heading to the next level,” Lee said.

Elton, for his part, said the success of the secondary market will also result in the success of the primary markets or galleries.

“People can only ever hang so many pictures on their walls. If they can’t find a good, fair, and honest way to sell things, they perhaps don’t want any more — they can never buy any more pictures from galleries. There’s a kind of circle of life going on here. It’s important for the primary markets to do well, but it’s super important for the secondary market like us to equally do well because we support each other,” Elton concluded.

Advertise

Advertise