Chart from OCBC.

Chart from OCBC.

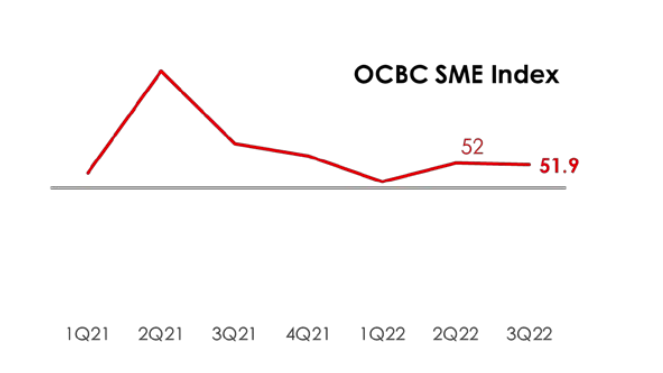

Chart of the day: OCBC SME Index remains expansionary for 7th quarter

Outlook for the fourth quarter remains good despite expectations to moderate downwards

This chart from OCBC shows the OCBC SME Index, a data-driven SME-focused index in Singapore based on the transactional data of SMEs, providing a barometer of SME business health and performance.

The index shows that Singapore SMEs registered 51.9 on the index. Growth was broad-based and supported by a healthy pick-up in consumer demand and international air travel. However, business sentiment however continued to be weighed down by concerns over rising inflationary pressures going forward, especially in energy and transport costs.

ALSO READ: SG’s top firms outperform global average in ESG reporting

A reading above 50 indicates improved activity whilst below 50 indicates a deterioration relative to the same period a year ago.

“The OCBC SME Index is likely to moderate downwards in the 4th quarter of 2022 but remains slightly expansionary, with growing downside risks arising from the softening in global and regional demand, persistent inflationary pressures especially in energy and manpower costs, and rising interest rates,” OCBC said.

Advertise

Advertise