Chart from AXA IM

Chart from AXA IM

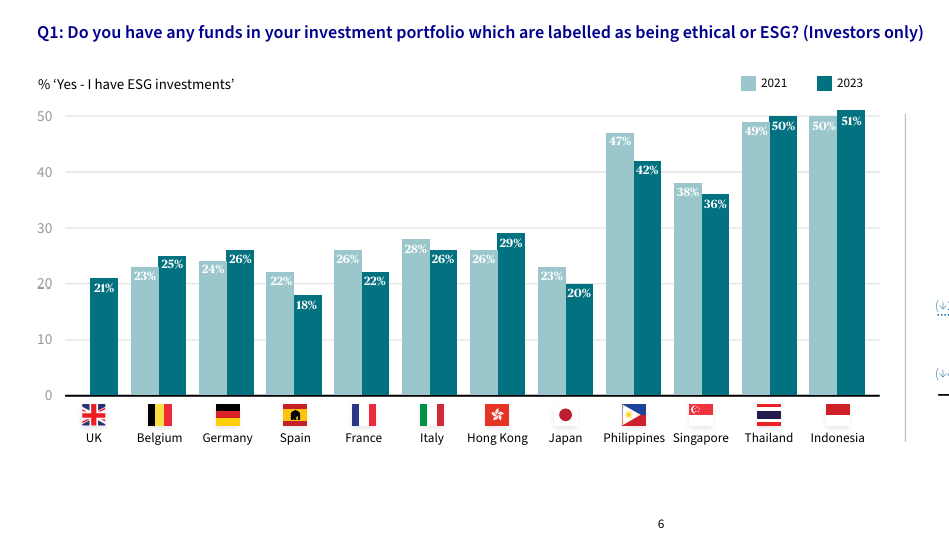

Report shows ESG investing in Singapore declining

Biggest barrier to investing was skepticism about the performance of these funds.

Singapore investors have become less active in ESG investing over the past year and have grown less hopeful about the ability of these funds to outperform, according to AXA Investment Managers.

In a recent study, AXA IM said the number of Singapore investors with funds labelled as being ethical or in line with ESG principles fell to 36% in 2023 from 38% during the previous round of study in 2021.

Of which, only 28% invested 40% or more of their portfolios in ESG funds last year, down significantly from 37% in 2021.

The decline followed an overall downtrend across Asia, where the proportion of investors holding ESG funds while keeping their allocation high has been shrinking. Bucking the trend was Japan, which has seen a higher proportion of investors investing a significant portion of their portfolio in ESG funds.

The report also found investors in the Lion City were among the least likely to expect an ESG fund to outperform, with only 28% believers last year compared to 38% in 2021. Joining Singapore investors in terms of managing their expectations were their peers in Japan and the UK.

“Overall, investors in Asia generally have stronger expectations surrounding the performance of ESG funds, although this has declined since 2021,” said AXA IM.

For those without exposure to ESG, the study showed fewer Asian investors were considering adding ESG funds to their portfolios last year (42%) compared to 2021 (46%).

“There has been a marked decline in the potential importance of ESG to non-investors. For current non-investors, who may invest in the future, ESG would only be an important factor in a minority of cases,” the report noted.

AXA IM said skepticism surrounding the performance of ESG-related investments was the biggest barrier to investing in the segment, calling the need to raise awareness and understanding of ethical investments in Asia.

Advertise

Advertise