Chart from Knight Frank

Chart from Knight Frank

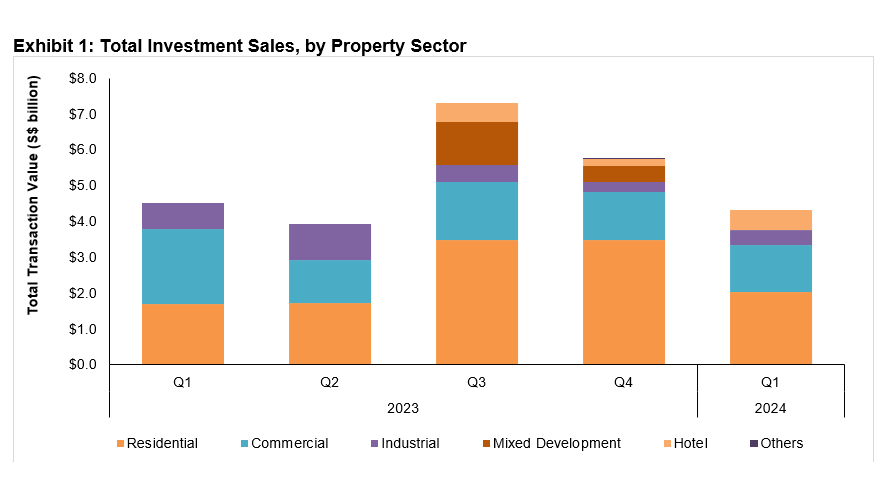

Residential sector lead 1Q24 investment sales

The sector accounted for 47.1% of investment deals.

Residential deals accounted for almost half of investment sales activity in Singapore in 1Q24, data from Knight Frank showed.

The residential sector recorded a total sales value of $2b, accounting for 47.1% of investment deals.

A significant portion of the residential investment sales in 1Q24 consisted of government land sales (GLS) sites designated for residential purposes, situated at Orchard Boulevard, Plantation Close, and Media Circle, which had a total value of $1.2b.

Compared to the 4Q23, however, residential investment sales activity declined 41.9% from $3.5b.

Knight Frank attributed the downturn to foreign buyers deterred by the prohibitive Additional Buyer's Stamp Duty (ABSD) rate introduced in April 2023.

Advertise

Advertise