Graph source: RHB

Graph source: RHB

S-REITs face better year ahead amid rate cuts, improving economy

The next major S-REIT rally is seen happening in Q2.

After a challenging 2023, Singapore-listed REITs are set to outperform this 2024 amid improving economic prospects at home and the earlier-than-expected rate cut signals by the Federal Reserve, according to RHB.

RHB equity analyst Vijay Natarajan said in a note that they expect the Fed to start cutting benchmark interest rates in the second half of the year, a development that bodes well for S-REITs.

Coupled with strong economic growth projections for Singapore this year, Natarajan noted that S-REITs focused on office and hospitality assets are set for a strong recovery play this year as they are well-positioned to capitalise on improving market conditions.

“We continue to recommend investors to add on market corrections with a balanced mix of industrial REITs for stable yields, as well as a mix of office, hospitality, and retail REITs to ride on the recovery and rebound from the turn in the interest rate cycle,” he said.

The next major rally for S-REITs is expected to only come in the second quarter onwards once the Fed starts bringing down its policy rates.

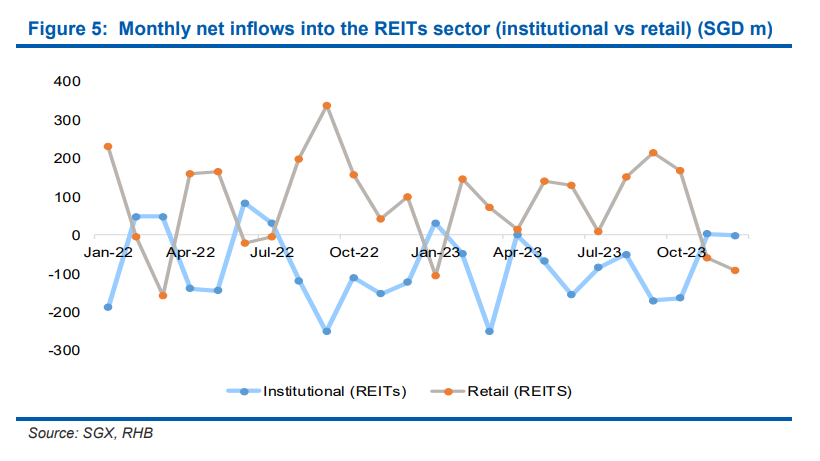

After staying on the sidelines over the past two years, institutional investors are also seen returning to the S-REIT market this year and give a further boost to the secor’s recovery later in the year.

Natarajan said S-REITs, across all sectors, are likely to become more active with their acquisitions in the latter half of 2024 once borrowing costs ease.

RHB maintained an “overweight” rating on S-REITs, with CapitaLand Ascendas REIT, Keppel REIT, AIMS APAC REIT and CDL Hospitality Trusts as its top picks.

Advertise

Advertise