Chart from Knight Frank

Chart from Knight Frank

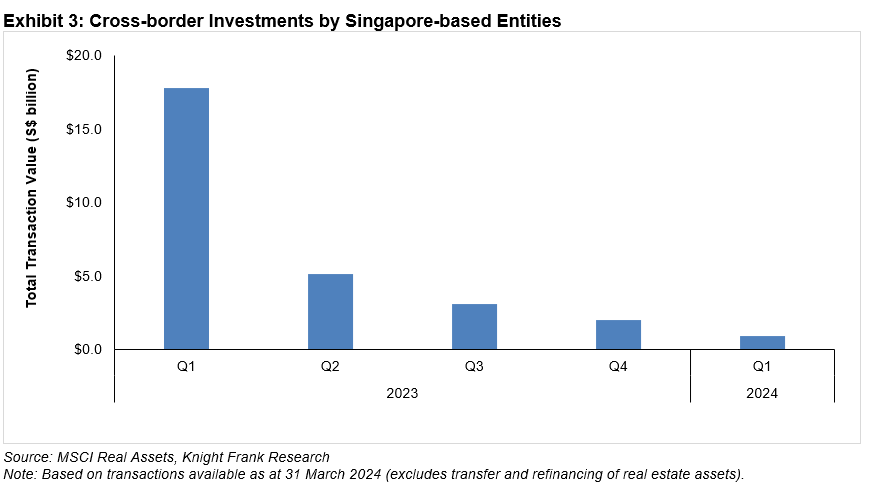

SG outbound investments plummet 94.9% YoY in 1Q24

Quarter-on-quarter, deals dwindled by 54.3%.

Outbound investments from Singapore have dipped 54.3% QoQ and 94.9% YoY to $911m in 1Q24, data from MSCI Real Assets showed.

Knight Frank said the drop is likely a result of market sentiment remaining “tentative and cautious.”

“Global investors are likely waiting for a reduction in interest rates or for global tensions to ease before making their next move. At the same time, many are in the process of discovery, evaluating potential acquisitions to pursue a deal when the time is right.

Some of the noteworthy outbound investments from Singapore in 1Q24 include StorHub’s acquisition of five assets for $403.0m in Australia in March and the purchase of Yardhouse in Central London by City Developments Ltd (CDL) for $148.6m in February.

Advertise

Advertise