Chart from Knight Frank

Chart from Knight Frank

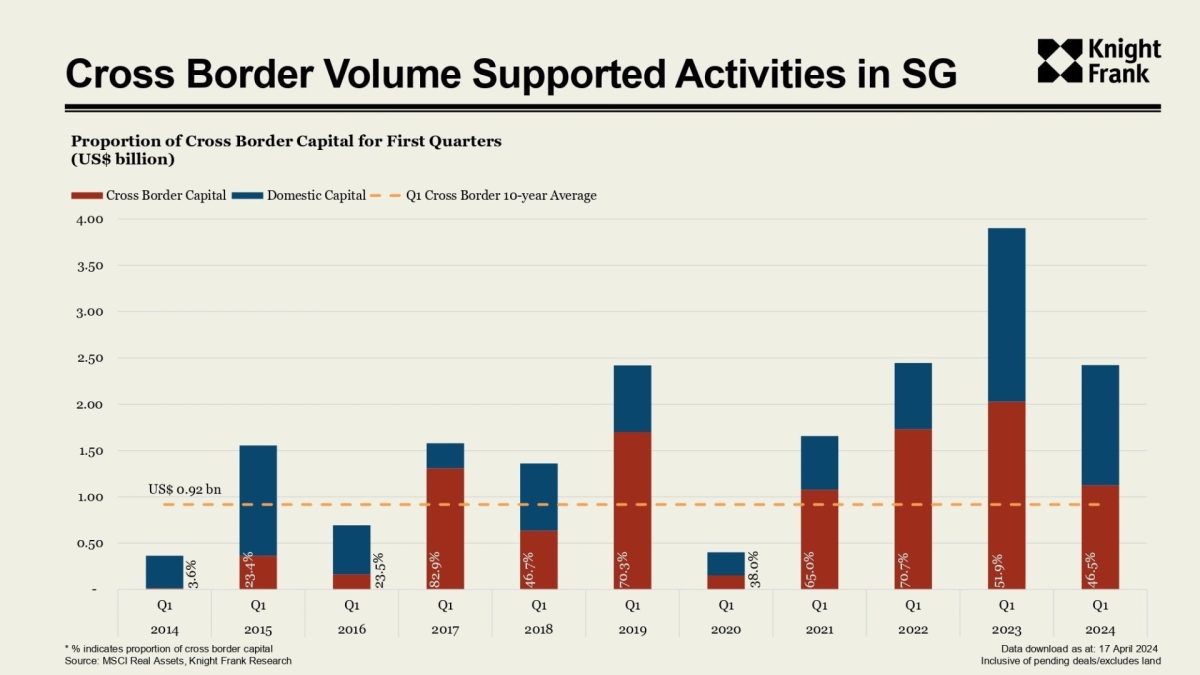

Singapore leads APAC in attracting cross-border capital

Overseas investments made up 45.6% of Singapore's capital in 1Q24.

Singapore received the highest portion of cross-border capital in Asia-Pacific, receiving US$906m from institutional investors.

Knight Frank data revealed that overseas investments constituted 45.6% of Singapore's total capital in 1Q24.

The hospitality sector was the key driver of growth in 1Q24, attracting significant interest from institutional investors.

“The market is ripe for increased investment activity, as investors are particularly drawn to value-added opportunities, signalling potential growth and development within this sector,” Knight Frank said.

“The MICE (meetings, incentives, conventions, and exhibitions) sector and government initiatives such as the China-Singapore 30-Day Mutual Visa Exemption have been instrumental in driving tourism demand,” Knight Frank added.

Knight Frank said investors and developers are teaming up to seize opportunities in Singapore's hospitality sector through improving existing properties to boost returns, citing Citadines Mount Sophia Singapore and Hotel G Singapore as samples.

Advertise

Advertise