Markets & Investing

Global M&A deals up, but nowhere near '07 high

Global merger-and-acquisition deal volume up 3% in 2010, hitting US$1.9 trillion in value, up 26% on 2009.

Global M&A deals up, but nowhere near '07 high

Global merger-and-acquisition deal volume up 3% in 2010, hitting US$1.9 trillion in value, up 26% on 2009.

S-REIT sector gearing remains at 34.4%

Even after acquiring c$6bn of assets YTD, S-REIT sector gearing remains low.

Asia Pacific equities posted US$3.3 billion net inflows

75% of fund managers overweight on Asia Pacific ex Japan equities, up from 44% in 3Q10, according to HSBC Fund Managers' Survey.

Asia equity fund fees among worlds highest averaging 0.83 %

Global emerging markets equity remains the most traditionally expensive asset class category with median fees averaging 1.0%, up from 0.90% in 2008.

Office rents to increase by 10% in 2011

Investment activity in the Central Business District office market is likely to remain strong.

Singapore on par with Germany on merger and acquisition activity

Asia is emerging as the most favorable region for global M&A activity outside the traditional Western markets.

STI steeped in uncertainty due to China's reserve rate hike

OCBC said only a clear break of the 3200 mark on the upside may provide stronger cues to the market as any attempt from Wall Street may still...

GIC holdings for China International Capital Corp increased to 16.35%

Government of Singapore Investment Corporation became the second-biggest shareholder in CICC. According to OCBC, the holdings increased from 7.35%...

2010 IPOs to exceed US$300bln

Surpassing the 2007 record of US$295 billion, total global IPO proceeds for this year are backed by Asian issuers raising the most capital.

CapitaCommercial Trust's 31% gearing secures Baa1 rating

CCT's cash balance of $731m provides it with ample financial flexibility for future acquisitions.

Singapore investment deals top $10.6b

An increase of up to $32.5b came in this year due to the rise of investment deals of at least $5m each.

Keppel Land foresees $719.8m net profit

A net gain of $394m is expected by Keppel Land instead of the $321m reported earlier.

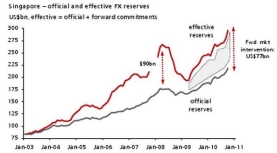

MAS’ attempt at currency control is mission impossible: DBS

DBS says the central bank’s US$17bn intervention in currency markets in October is part of its attempt to do the impossible— to control the currency...

DBS asset management acquires 7.25% interest in Nikko asset management

Nikko Asset Management will obtain DBS Asset Management for S$137 million in their signed agreement to combine both asset managements.

Keppel expects 4.0% net profit growth for FY2012E

Keppel Corporation said year-on-year increase of 9.6% in net profit is expected for FY2010E. A slow and steady growth in its net profit is forecasted...

Singapore ranked Asia Pacific's 3rd biggest in investment volume

A huge rise of 358% growth in investment volumes was recorded for Singapore. According to Jones Lang LaSalle's Capital Markets Bulletin, this growth...

Kim Eng expands retail investor base with its first investor centre

The group has also launched KE Forex, for trading foreign exchange and KE Trade Mobile, a iPhone app for stocks trading.

Advertise

Advertise