Chart from Colliers

Chart from Colliers

Singapore industrial rents, prices seen easing this year

1.6 million sqm of supply expected to come online this year.

Singapore’s industrial real estate sector will likely see sluggish price and rental growth for the rest of the year as supply continues to increase, according to Colliers.

In its latest quarterly market report, Colliers expects overall industrial rents to grow at a moderated pace of 3% to 5% for 2024, while prices are projected to rise at a much slower clip from 1% to 3%.

The property agency said the slowdown was primarily caused by the surge of new supply coming onstream this year through 2026, estimated to average at 1.1 million sqm each year. This exceeds the 1 million sqm average annual supply as well as the 600,000 sqm of net absorption recorded each year over the past three years.

It said higher cost of capital, tenants’ resistance to higher rents and an anemic global economic expansion will further put downward pressure on rental growth this year.

On the flip side, Colliers said leasing demand is expected to receive a boost from Singapore’s recovering manufacturing sector.

“The global demand for artificial intelligence chips is expected to have spillover effects and provide tailwinds for the industrial sector, while international firms continue to set up or expand their manufacturing operations in Singapore,” Lynus Pook, Colliers’ executive director for industrial services in the city-state.

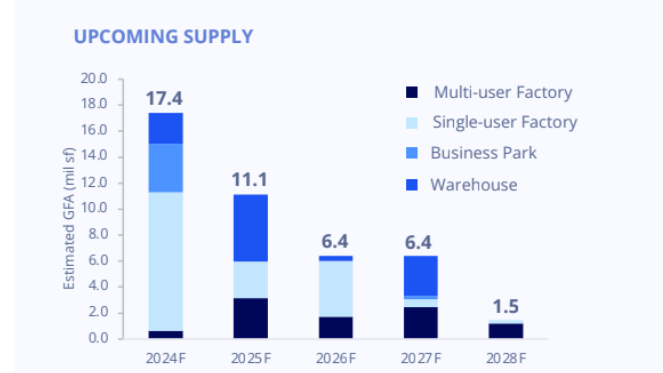

Estimates by the property agency showed 17.4 million sq ft (1.6 million sqm) of industrial space will become operational this year. The majority are single-user factories, with the remaining space spread across business parks, warehouses, and lastly, multi-user factories.

Colliers projected that 11.1 million sq ft (1 million sqm) of industrial space will be completed in 2025, and another 6.4 million sq ft (0.6 million sqm) of new supply will hit the market by 2026.

Rents of all types of industrial assets across the city-state went up 1.7% QoQ in the first quarter, rising for the fourteenth consecutive quarter. Prices, however, declined for the first time in over three years with a 0.2% dip last quarter.

READ MORE: Singapore industrial rents rise 1.7% in Q1, prices dip for the first time in over three years

Advertise

Advertise