Buyback value soars threefold to $52m in November

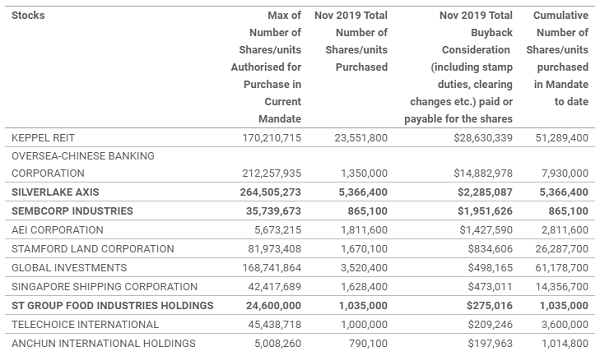

Keppel REIT led the pack at $28.63m or 51.29 million shares.

Total share buyback consideration have totaled $52m in November, up threefold from the $15.2m reported in October, according to an SGX report.

There were 15 SGX primary-listed stocks that reported buybacks of their SGX-listings over the same period, buying back a total of 43.5 million shares or units. Keppel REIT led the figure as it bought back $28.63m or 51.29 million shares.

This is followed by OCBC at $14.88m or 7.93 million shares.Silverlake Axis closed the top three at $2.26m or 5.37 million shares.

For the first 11 months of the year, the total buyback consideration of SGX primary-listed stocks amounted to approximately $522m. SGX noted that this is just one-third of the $1.45b posted in 11M 2018 and was more on-par with the $383 in 11M 2017.

In addition, the monthly buyback figure is half compared to $108.9m in November 2018, which had been mainly driven by the three banks, UOB, DBS and OCBC.

The Straits Times Index (STI) declined 1% to 3193.9 in the same month, from 3,229.9 at end-October, bringing STI’s total return for the ten months of 2019 to 8%. For the 11 month-period, the30 STI stocks have seen a combined net institutional net inflow of $1.15b.

SGX also added that there were three stocks that commenced new mandates, which are Silverlake Axis, Sembcorp Industries and ST Group Food Industries Holdings.

Silverlake Axis bought back as much as 0.2% of its issued shares as compared to its preceding buyback mandate where it bought back 0.27%.

Advertise

Advertise