February buybacks doubled to $67.9m

Over half of the buybacks for the month were made by DBS.

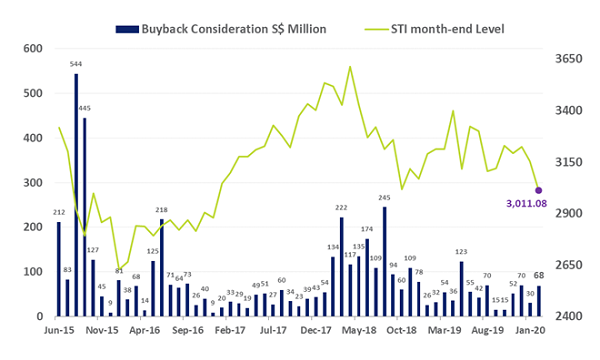

The total share buyback consideration in February doubled to $67.9m compared to $29.9m recorded in January, according to an SGX report. This monthly figure is greater than the $32m posted in February 2019 and above the average monthly buyback consideration of $49m for 2019.

Overall, buybacks were conducted on 17 primary-listed stocks, translating to a total of 1.68 billion shares bought back.

DBS led the pack as its buyback consideration totalled $43.09m with 1.75 million shares, priced at an average of $24.623 apiece. It took up over half of the total buyback consideration for the month.

It was followed by Keppel Corp which bought back 740,100 shares for $4.97m and Silverlake Axis with $4.63m for 13.73 million shares.

Other companies at the top were OCBC ($3.28m), Starhub ($2.91m), MDR ($1.66m) and Singtel ($1.69m). MDR bought back the largest number of shares at 1.67b for $0.001 apiece.

Furthermore, SGX noted that there were three stocks that commenced new mandates in February: Singtel, The Hour Glass and Goodland Group. The telco firm bought back shares at an average price of $3.296, compared to its preceding buyback of $1.4m in shares at an average price of $3.117 on 16 May 2019.

The report added that the Straits Times Index (STI) declined 4.5% in February, hit by concerns over the potential economic impact of COVID-19 in the US economy and other more US-centric factors, saw the Dow Jones Industrial Average decline 14% from its 12 February all-time through to the end of February.

Advertise

Advertise