iEdge SG Real Estate 20 Index posted total return of 20.2% YTD

The best-performing stock amongst the constituents is Mapletree Logistics Trust.

The 20 constituents of the iEdge SG Real Estate 20 Index has generated a total return of 20.2% YTD, according to an SGX report. Its total return for the past three years totalled 46.6%, which represents an annualised total return of 13.6%.

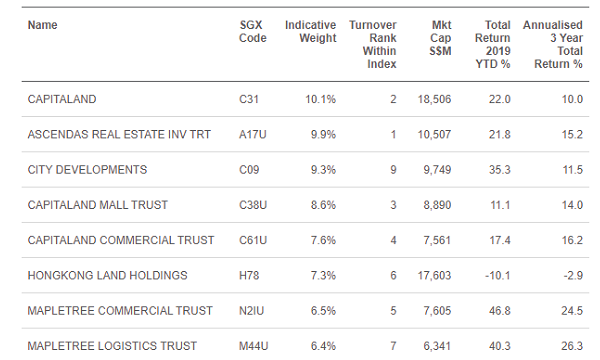

SGX noted that real estate developers and managers accounted for more than a third of the Index weights, with the remainder made up by REITs and property trusts. The six developers and managers generated mixed total returns in the 2019 YTD, from Hongkong Land’s decline of 10.1% to City Dev’s gain of 35.3%.

“Despite the comparatively strong REIT market during the same period, developers contributed two of the Index’s five strongest performers,” SGX stated.

The strongest performer amongst the 20 constituents is Mapletree Logistics Trust (MLT), which will join the Straits Times Index on 23 December. As of 30 September, its 137 logistics assets in Singapore, Hong Kong, Japan, China, Australia, South Korea, Malaysia and Vietnam maintained an AUM of $7.95b.

Overall, the iEdge SG Real Estate 20 Index represent 14% of the total market value of all stocks listed on SGX and also accounts for 26% of the day-to-day trading turnover in the 2019 YTD.

The iEdge SG Real Estate 20 Index is a free-float market capitalisation weighted index that measures the performance of the largest and most tradable companies in the broader index. It comprises six real estate development and management companies, with 14 trusts consisting of 13 REITs and one stapled trust.

In addition, the index has seen its Sharpe ratio pick up to 1.25 over the 12 months ending November, with its longer term three-year Sharpe Ratio at 0.81. Sharpe ratios compare risk-free rates with the return of the index and standard deviations of the index’s return.

Advertise

Advertise