S-REITs total $147m net institution outflows in June-August

Sabana REIT saw the sector’s highest proportional net institutional inflows.

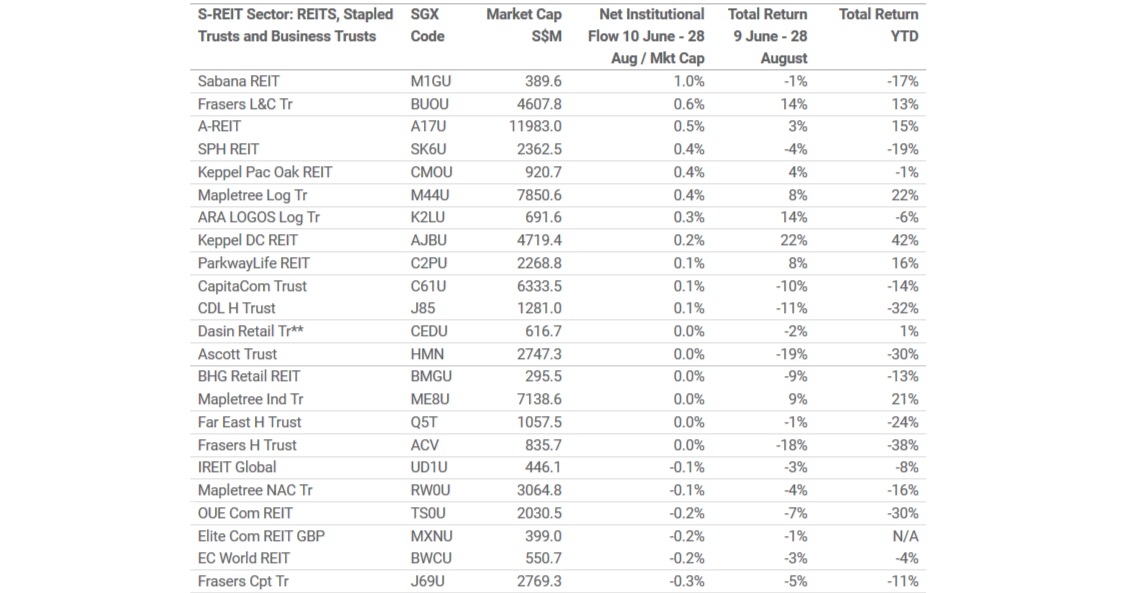

Singaporean REITs received $147m in net institution outflows since 9 June to 28 August, according to data from the Singapore Exchange (SGX). This is a 3% decline compared to the peak recorded in the i-Edge S-REIT Leaders Index forum from 23 March to 9 June.

A total of 13 trusts of the S-REIT sector saw net institution inflows over the 12 weeks, the bourse noted. Amongst these, Sabana REIT saw the S-REIT sector’s highest proportionate net institutional inflows during the period, at 1%. However, its total return dropped 17% year-to-date (YTD).

This was followed by Frasers Logistics & Commercial Trust (FLCT); Ascendas REIT (A-REIT); SPH REIT; Keppel Pacific Oak REIT; Mapletree Logistics Trust; ARA LOGOS Logistics Trust; and Keppel DC REIT.

Seven of the top 10 included are the S-REIT Sector’s best performers over the period, including Keppel DC REIT which has been amongst the 25 strongest performing global REITs in the 2020 YTD.

By comparison, the 10 trusts of the S-REIT sector that saw the highest net institutional inflow proportionate to market capitalisation following the major market lows of 23 March through to the post-low of 9 June included: First REIT, A-REIT, FLCT, Mapletree Logistics Trust, Soilbuild Business Space REIT, Keppel REIT, EC World REIT, Keppel Pacific Oak REIT, Ascott Trust and SPH REIT.

During the 12-week period, the 10 trusts averaged a 54% total return compared to the remaining trusts of the S-REIT Sector gaining 45%.

Advertise

Advertise