Stock market booked $1.17b net institutional outflow in H1

UOB, OCBC, Singtel and Yangzijiang Shipbuilding book the most inflows.

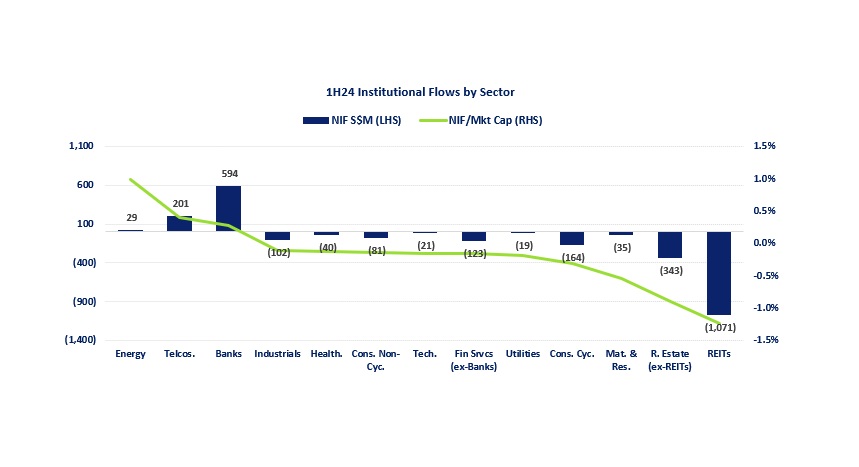

Singapore’s stock market logged $1.175b of net institution outflow during the first six months of 2024, according to data shared by the Singapore Exchange (SGX).

As of 30 June, the total market capitalisation of the Singapore stock market stood at $793b. For every 9 stocks that booked net institutional outflow in H1, 8 stocks booked net institutional inflow, the SGX said.

Per sector, energy made up $29m of the net institutional inflow, representing 1% of the combined $2.9b sector market capitalisation as of end June.

The S-REIT sector’s net institutional outflow, meanwhile, represented 1.2% of its sector market capitalisation.

The three strongest growing sectors in the Singapore economy in Q1 included transportation and storage; finance and insurance; and information and communications.

By company, UOB, OCBC, Singtel, and Yangzijiang Shipbuilding booked the highest net institutional inflow in H1.

Advertise

Advertise