Buyback consideration hit $663m in H1

DBS, OCBC and UOB saw the highest amount of buyback consideration.

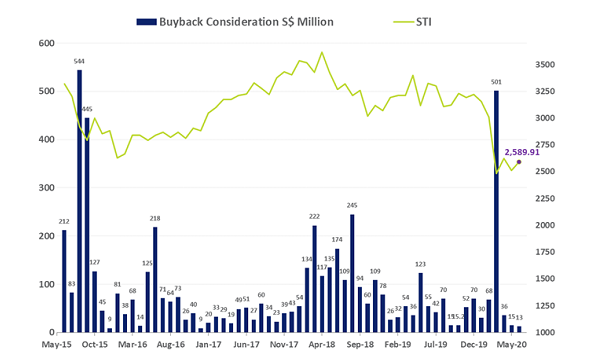

Total share buyback consideration in H1 amounted to $663m from 81 stocks that bought back their shares over six months, according to an SGX report. As many as 65 of these stocks bought back their shares in the volatile month of March.

The $663m in consideration in H1 represents 0.08% of the $817b total market capitalisation of all stocks listed on SGX. The top 30 stocks that conducted buybacks during this period made up 98% of the $663m in total buyback consideration, following the $590m figure posted in 2019.

DBS, OCBC and UOB led the buyback consideration, which came after OCBC, DBS and Keppel REIT led the consideration tally for the full 2019 year. The three non-STI stocks that led the buyback consideration tally in H1 were Silverlake Axis, Global Investments and Golden Agri-Resources.

Furthermore, March also accounted for $502m or 76% of the total $663m in total consideration in H1. The total figure is also higher compared to the $325m seen in H1 2019. On the other hand, the Straits Times Index (STI) saw a 17.7% in total return in Q1 to 2,589.91, beating its 9.4% gain in 2019.

As for the buyback consideration in June, the amount totaled $12.6m, slightly lower from $14.9m in May. SGX led the pack as it bought back about 895,900 shares for $7.34m. Global Investments, Hong Fok Corporation, Singapore O&G, Telechoice International and Avarga commenced new buyback mandates in June.

Advertise

Advertise