Securities daily average value up 15% to $1.2b in July

Equity market activity remained higher than a year earlier but moderated from a strong June.

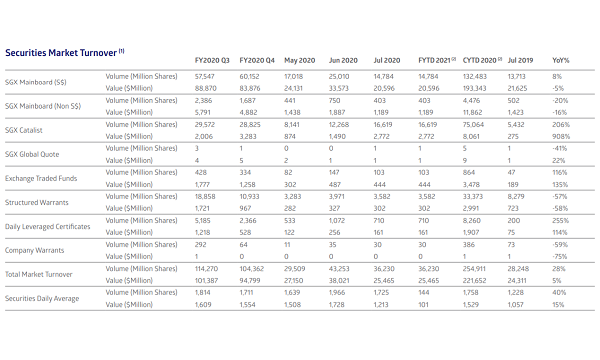

Singapore Exchange (SGX) has reported that the securities daily average value (SDAV) jumped 15% YoY to $1.2b in July. Total securities market turnover likewise rose 5% YoY to $25.5b in the same month.

Exchange-traded fund (ETF) turnover more than doubled YoY to $444m on institutional and retail investor interest, particularly around the SPDR Gold ETF—which was driven by surging gold prices—and STI ETFs. Assets under management (AUM) of SGX-listed ETFs grew 20% to $6b.

Markets continued to focus on the ongoing reopening of global economies and news of fresh waves of COVID-19 infections in some countries. Equity market activity remained higher than a year earlier but moderated from a strong June, whilst the equity index futures trading was more active as risk management remained in focus, SGX said.

Total equity funds inched up 6.7% YoY to $522m in July, after medical services group Singapore Paincare Holdings joined the local bourse.

Bond listings similarly improved from June amidst more certainty about the outlook for interest rates. A total of 72 new bonds raised $35.5b, though a more relaxed figure compared to its pre-COVID-19 levels.

SGX added that risk management activities buoyed equity index futures volumes. The total number of financial derivatives jumped 26% YoY at 23.8 million contracts, boosted by the equity index futures. The FTSE China A50 index futures traded 76% more contracts YoY at 12.8 million contracts, whilst the Nifty 50 Index futures saw a 19% YoY jump to 2.1 million contracts. The MSCI Taiwan Index futures also edged up 4% YoY in volume to 1.8 million contracts in July.

The SGX FTSE Taiwan Index futures contract began trading and achieved a total volume of 82,048 contracts in two weeks. It was joined by over 60 trading entities.

Together with the MSCI Taiwan Index futures, SGX has 99.8% of volume and open interest market share across all offshore Taiwan equity index price return futures.

Meanwhile, FX derivatives volume moderated due to a dip in volatility with total volume a fifth lower YoY at 1.7 million contracts, and INR/USD futures volume a quarter down to 923,861 contracts.

Commodities inched up 1% YoY in volume to 2.1 million contracts over the same period, amidst China’s reopening and continued supply chain disruption. Iron ore derivatives had 2% more volume YoY at 1.8 million contracts, whilst forward freight derivatives saw an 8% rise in volume to 102,740 contracts.

Advertise

Advertise