STI returns crashed 17.6% to 4.1% YTD

However, returns are on a path of recovery as its constituents bounced back from its lows.

The total returns of the Straits Times Index (STI) shrank to 4.1% over its first two sessions in June, which shows a 17.6% fall during 2020 YTD, an SGX report revealed.

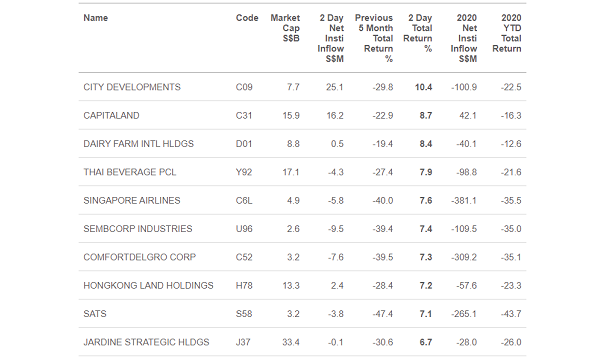

However, SGX noted that its constituents City Developments (CDL), Thai Beverage, Singapore Airlines, Sembcorp Industries, ComfortDelGro, Hongkong Land Holdings, SATS and Jardine Strategic Holdings, which are in the STI’s least performing stocks for the first five months of 2020, reversed to be amongst the index’s 10 strongest over the first two days of June.

CDL, which declined 30% in 2020 YTD, rallied 10% over the past two days with a $25m net institutional inflow. These eight firms averaged a 7.7% total return over the two sessions. CapitaLand and Dairy Farm International Holdings were also amongst the 10 strongest stocks of the session with respective gains of 8.7% and 8.4%.

Meanwhile, Mapletree Logistics Trust, Ascendas REIT and Wilmar International were all amongst the five weakest STI stocks over the past two sessions with an average total return of 0.1%. The three were in the five strongest STI constituents in the first five months of 2020, with average total returns of 7.7%.

SGX also added that there were further declines in the US dollar with muted moves in US 10-year notes, and have also led support to the FTSE ASEAN All-Share Index, which gained 2.9% over the past two sessions. As of the 3 April close, the STI was 2.2% below the 17 April high of 2,671.6 and 18.3% above the 23 March low of 2,208.4.

Advertise

Advertise