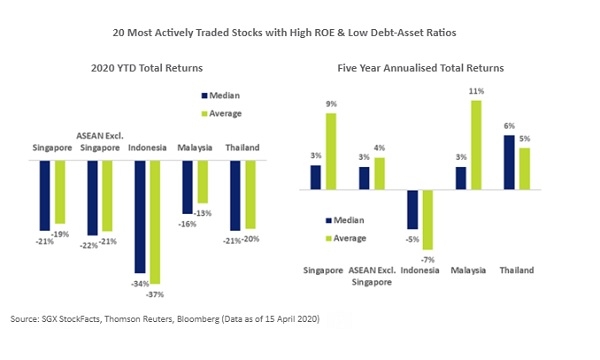

Stocks with high ROE and low debt post 19% average drop YTD

This mirrors the declines recorded in ASEAN stocks of the same criteria.

The top most traded Singapore-listed stocks with high return-on-equity (ROE) and low debt-to-asset ratios generated declines averaging 19% in 2020 through to 15 April, in line with the Straits Times Index’s (STI) figures, according to a Singapore Exchange (SGX) report.

In contrast, these stocks generated median returns that delivered an additional 3% annualised total returns over the five-year period ending 15 April, compared to a 2% decline for the STI and FTSE ST All-Share Index.

These 20 stocks maintained ROE above 10% and a debt-to-asset ratio below 30% as of 15 April.

Convergence was also observed across the ASEAN neighbours, with 20 stocks under the same criteria averaging a 21% decline, in line with the 21% decline of the FTSE ASEAN All Share Index.

Likewise, the 20 ASEAN stocks outside Singapore generated median returns that recorded an additional 3% annualised total returns, compared to a 5% fall for the FTSE ASEAN All-Share Index.

The 20 SGX-listed stocks recorded net institutional inflows totaling $1.9b, but also received $2.5b of net inflows by retail investors.

Singapore Exchange lists close to 100 stocks with 12M trailing ROE above 10% and a debt-to-asset ratio below the local market average of 30%.

Advertise

Advertise