Chart of the Day: Here's how saturated Singapore's mobile market is

Not to mention a possible second mobile virtual network operator.

OCBC Investment Research noted that with Singapore’s mobile penetration rate already at ~150%, growth in number of subscribers going forward will be limited and slow, if any.

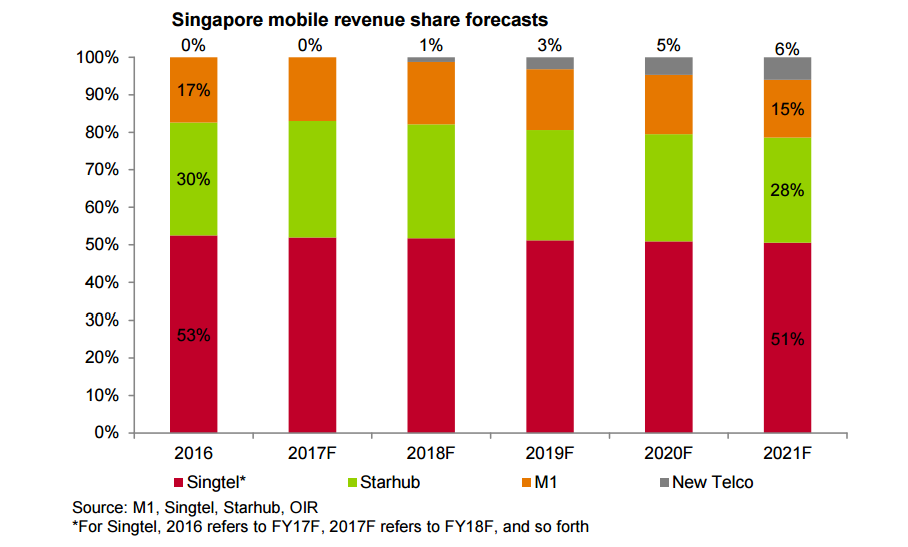

"Coupled with falling ARPU (average revenue per user) amidst intensifying competitive environment, we forecast for total mobile revenue to decline ~12.4% between CY16 and CY21 (FY22 for Singtel). In our base case assumption, we also forecast for TPG to achieve ~6% mobile revenue share by CY21," it said.

Here's more from OCBC:

We highlighted in our 9 Dec 16 sector report not to take Circles.Life too lightly, and rightly so, especially given the recent launch of its aggressive data plan offering priced significantly lower that the incumbents, which we believe will put further pressure on ARPU even before TPG’s launch.

Looking ahead, we believe MyRepublic, having lost the NESA to TPG, may potentially launch an MVNO (mobile virtual network operator) mobile service in Singapore even before TPG launches its mobile services.

If this happens, we see further downside to our forecasts as mobile revenue decline will likely accelerate on the back of a greater fall in ARPU.

Advertise

Advertise