Chart of the Day: What you need to know about SingTel's earnings

A ‘flattish’ earnings profile looms in FY13.

Barclays Research noted:

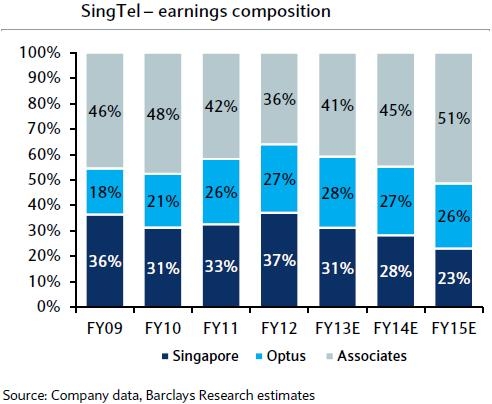

Following our earnings revisions to incorporate Bharti’s revised earnings profile, we now expect a flattish earnings profile for SingTel in FY13 – but then we see solid 8% three-year earnings CAGR thereafter. A 70% payout on our estimates is 5.3% yield off FY13E earnings, growing to 6.2% in two years as earnings grow. Potential asset monetization points to further upside through potential special dividends into FY14E. We reiterate our OW rating with a slightly higher PT of S$3.50 (vs. S$3.45 earlier).

We stay OW on three counts: 1) Bharti’s earnings downdraft drives a flattish earnings profile for FY13 but is set for an 8.0% three-year CAGR thereafter; 2) 70% payout on our estimates is 5.3% yield off FY13E earnings, growing to 6.2% in two years as earnings grow; and 3) we see AssetCo monetization efforts becoming more visible into 2013 – definitive progress should then start to drive special dividend expectations.

AssetCo stake divestiture due in 2013. SingTel has undertaken to the IDA to reduce its stake in NetLink Trust to less than 25% by April 2014. As more visibility around this effort builds into 2013, we see expectations of cash realization and capital return to shareholders as likely positive catalysts. SingTel transferred these passive assets into the business trust for S$1.89bn (S$0.12/SingTel share) – one indication of SingTel’s own perception of the value involved.

Earnings revisions, new PT of S$3.50. Upward revisions to Telkomsel valuations offset the downward revisions to Bharti’s – we inch up our PT to S$3.50. Bharti’s earnings revisions are the primary driver of the changes in our SingTel estimates. We revise down our profit estimates by 4.5%/8.5% for FY13 and FY14, respectively; we fine-tune operating EBITDA estimates (Singapore and Optus businesses) by -1.2% and -2.3% for the two years.

Advertise

Advertise