Warehouse rents extend steep decline in Q2

The oversupply situation is weighing on rental growth.

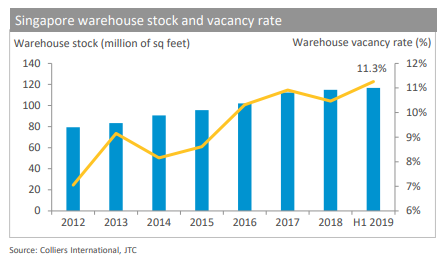

Island-wide warehouse rents have been on a consistent downward trend for more than five years, with the rental index crashing 19.4% in Q2 2019 from its peak in Q4 2013, reports Colliers research.

Also read: Chart of the Day: Warehouse rents down 1.5% in Q2

Colliers attributes the rental decline to the influx of new supply averaging 6.3 million sq ft or equivalent to 7.6% of total warehouse stock per year during the 2014-18 period. With a limited domestic population of 5.7 million, Singapore has one of the highest per capita warehouse spaces in Asia.

Also read: Chart of the Day: Over 1.2 million sqm industrial supply to come online by 2019

However, warehouse supply is expected to ease, with warehouse total stock averaging at 1.5% over 2019-2023 vs. 7.6% from the previous period of 2014-2018, which could push vacancy levels to stabilise at 10.8%.

Also read: Chart of the Day: Industrial property supply to crash in 2022

However, Colliers expects logistic rents to remain soft in response to a deterioration in global trade and economic slowdown, declining marginally by 1.5% and 1.0% YoY in 2020 and 2021 respectively, before recovering after 2022 as the overall industrial sector bottoms out.

Advertise

Advertise