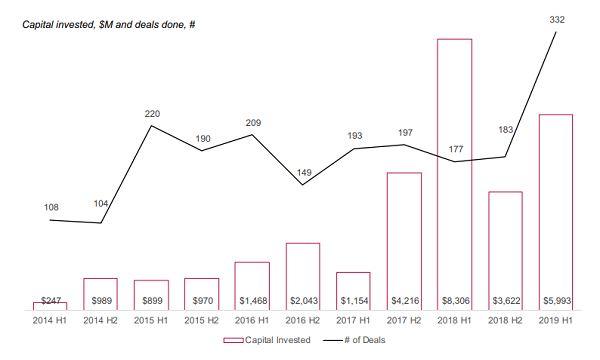

SEA hits record-high number of tech investments in H1 2019

However, total deal amount fell short of last year's tally due to lack of mega-deals.

Tech investments into Southeast Asia fell to US$5.99b from US$8.31b at H1 2018 even as the number of deals rose to a record-high, according to a Cento Ventures report.

The number of deals lower than US$50m is expected to rise at 638 from 325 on 2018. Only 50% of the total capital in the half-year period came from "mega deals" as compared to 70% in 2018. The increase in deal numbers was attributed to investments from a growing number of accelerators and incubators like Antler, SKALA, and Accelerating Asia.

Also read: Asia's fintech investments hit $22.7b in 2018

The average size of Series B deals also increased to US$12.0m from US$6.2m in 2014.

In Southeast Asia, Vietnam saw the largest gain in share of capital invested from 5% in 2018 to 17%, attributed to having produced more later-stage companies like Tiki, VNPay, and Vntrip.

Indonesia and Singapore continued to hold the majority of investments in Southeast Asia. Indonesia's share decreased to 48% from 77% in 2018 although the Centro Ventures noted that this might still change in the second half of the year.

Meanwhile, Singapore's share of investments increased to 25% from 13% previously given its new cohort of later-stage companies like QExpress, Carousell, and Taiger.

The report also observed a growing number of later-stage companies crossing the "unicorn" zone, particularly Bulakapak, Zilingo, PropertyGuru, and Qoo10.

Sector-wise, Logistics and Healthcare hold the distinction as two of the most funded sectors, with invested capital of US$143m and US$128m, respectively, in H1 2019.

The total investment in 2019 is expected to match 2018 levels as Grab, Go-jek, Traveloka, and Tokopedia continue to gain sizable funding rounds.

Advertise

Advertise