Semiconductors to continue its outperformance: RHB

Firms that have retained clients could see a ramp-up of orders this year.

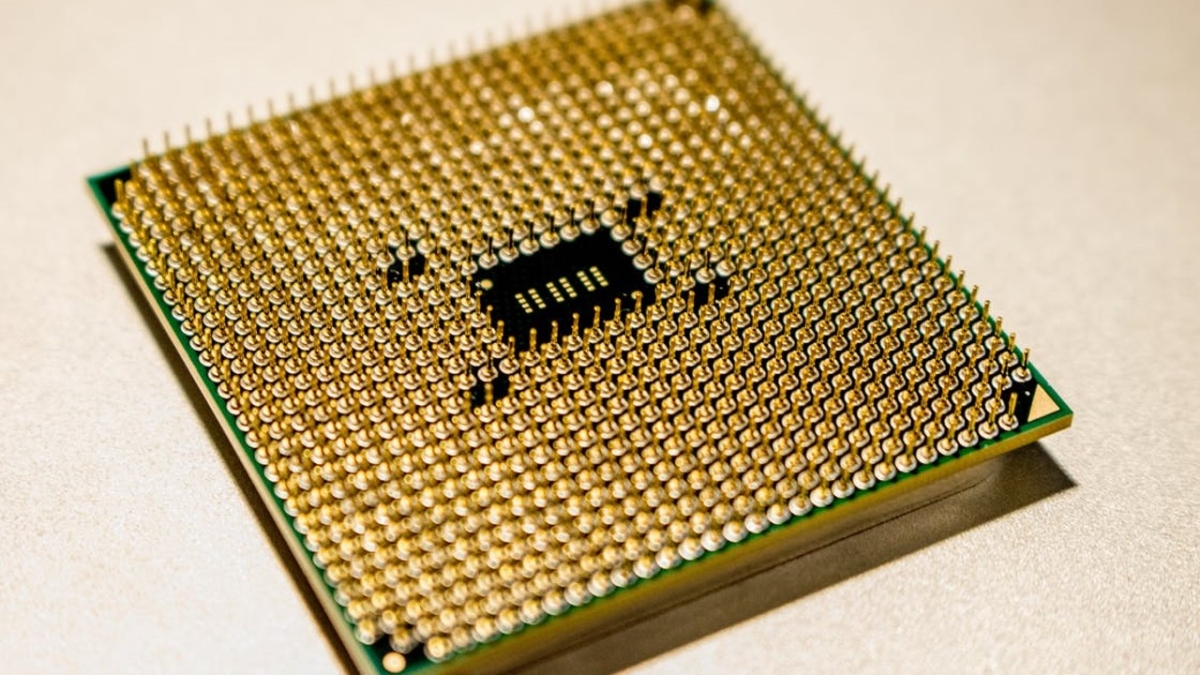

According to a report released by RHB, the semiconductor industry is expected to continue its outperformance amidst the global chip shortage.

There are 29 new fabrication facilities planned for construction in the next few years, which is expected to ensure high demand for the product.

"However, as the overall performance of the technology stocks under our coverage is only at an acceptable level, we remain neutral on the sector but maintain selectively positive on the semiconductor supply chain beneficiaries," said RHB Analyst Jarick Seet in the report.

Strong equipment spending is also expected in the coming years. Citing figures from SEMI, RHB noted that more than $190b (US$140b) is expected to be spent over the next few years. Of the above-mentioned fabrication facilities, 19 have started construction, with 10 looking to break ground in 2022. Of these 29, 15 are foundry facilities with the capability to produce 30,000 to 220,000 wafers per month.

Meanwhile, the memory sector is also slated to begin construction on four fabrication plants over 2 years. An improvement in capacities from 100,000 to 400,000 wafers per month is expected.

RHB cited SGX-listed Frencken as a firm that has continued to take in large orders from the medical industry for imaging and scanning-related equipment. With clients reducing the number of their go-to parts manufacturers and making bigger orders from their remaining suppliers, firms such as Frencken could see a ramp-up in orders this year.

The brokerage firm is also bullish on SGX-listed manufacturers Fu Yu Corp and Venture Corp, the former for diversifying its business of supply chain management for commodities, and the latter due to improved profitability and margins.

Advertise

Advertise