HDB, condo rental sales drop to lowest levels since circuit breaker

This may indicate that foreigners are exiting prime locations for more affordable housing.

HDB and condo rental sales volumes both recorded double-digit contractions in August amidst a possible exodus of expats from Singapore’s prime housing locations as foreigners’ unemployment level rises, according to analysts.

A total of 1,025 HDB flats were rented in August, 46.2% lower compared to the same month in 2019, according to data from the SRX. This is also a 16.7% drop from the previous month’s 1,230 units rented.

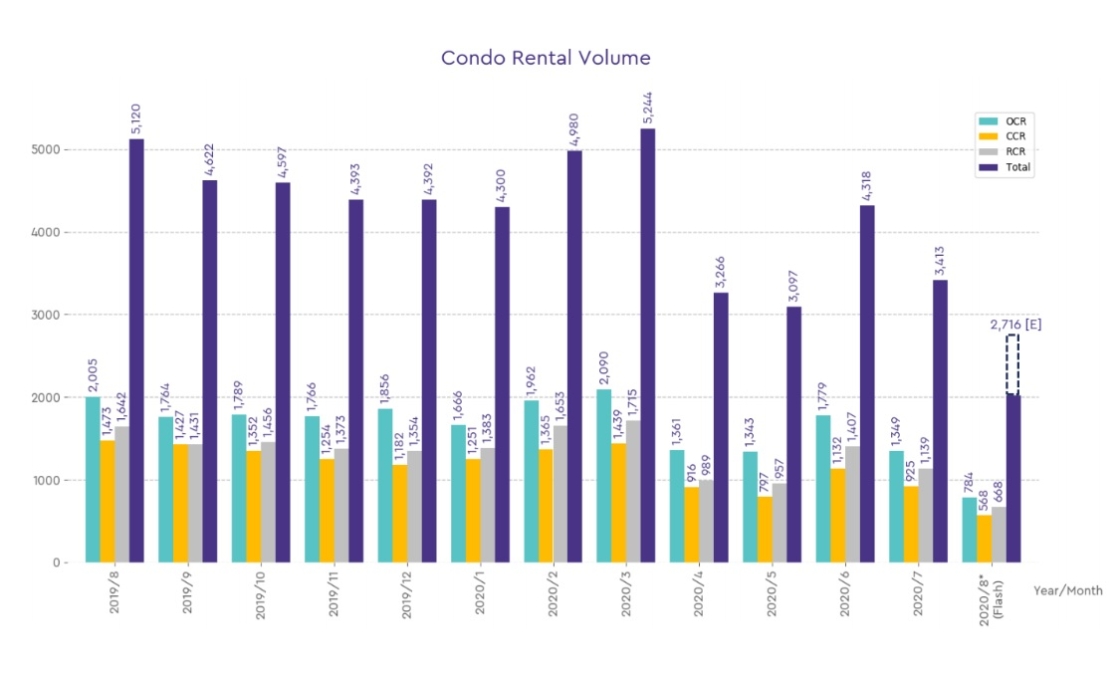

Condo rental volumes followed the same dramatic contraction, falling by 47% YoY to 2,716 rented units, or a 20.4% decline from July’s 3,414 rented units.

HDB rental volumes and condo rental volumes are also 44.1% lower and 42% lower than their 5-year averages for the month of August, respectively.

This marks the second consecutive month of rental volume declines for both the private and HDB resale market, said Christine Sun, head of research & consultancy, OrangeTee & Tie.

“The rental market could be experiencing the start of a domino effect of an economic slowdown and rising unemployment amongst foreigners here,” Sun said.

“As the current jobs support schemes are intended to help firms retain their local workforce, it is inevitable that a cutback in foreign employment will adversely impact the leasing market temporarily,” she added.

Sun noted that rental vacancies may increase in the coming months, which may exert downward pressure on rental prices for certain locations.

Furthermore, although the overall SRX rental index held steady for the private residential market last month, rents have already dropped a sixth consecutive month for luxury homes in the core central region (CCR), .according to Sun Rents have also slipped marginally in the outside of central region (OCR).

“The trends may indicate that more expats are moving out from prime locations to suburban areas or city fringe areas where housing tends to be more affordable in light of the current economic slowdown,” she said.

Prices remained stable with HDB rents dipping 0.1% YoY in August whilst condo rents fell by 1% YoY compared to the same period last year. Compared to July, HDB rents edged up 0.3% whilst condo rents remained unchanged overall.

HDB rent prices for 3-Room, 5-Room, and executive units decreased by 1.3%, 0.7%, and 2.6% in August compared to a year earlier. In contrast, 4-Room rents inched up by 0.9%.

Overall, HDB rents are down 14.6% from the peak in August 2013.

Meanwhile, condo rent prices in the CCR and RCR decreased by 2.4% and 1.9%, respectively, compared to August 2019. On the other hand, OCR rents rose by 0.5% over the same period of comparison.

Condo rents are down 17.3% from the peak in January 2013.

Advertise

Advertise