Luxury condo sales surged 72% in Q1 despite weak property market

The new sales segment boosted the quarterly figure, led by The M with 387 units.

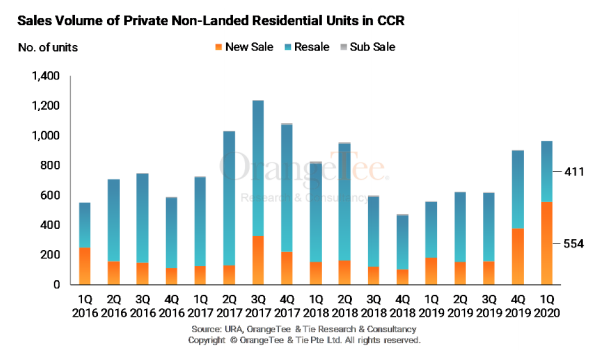

The number of sold non-landed luxury homes soared 72% YoY to 965 units in Q1 from 561 units in Q1 2019, defying the odds amidst current market uncertainties, according to the Private Residential Market report of OrangeTee & Tie.

On a quarterly basis, posh home sales rose 7.1% QoQ from the 901 units transacted in Q4 2019.

“The stellar sales could be attributed to the new sale segment where 554 new luxury condominiums were transacted last quarter,” noted Christine Sun, head of research & consultancy at OrangeTee & Tie.

Amongst the segment’s most notable deals during the quarter came from The M, which sold 387 units, whilst Leedon Green moved 41 units. Sales also picked up at several completed projects such as Marina One Residences, which sold 71 units at an average price of $2,331 psf. Sixteen units at D’Leedon were transacted at $1,608 psf; whilst another 10 units at 8 Saint Thomas at $3,126 psf.

Overall, the average price of non-landed resale luxury homes held relatively steady at $2,020 psf, whilst new non-landed homes in the Core Central Region (CCR) were sold at $2,540 psf in Q1.

However, the proportion of luxury homes that were sold at a lower price quantum rose in the same quarter. Around 80.5% were transacted below $3m, compared to 73.9% in the preceding quarter.

The luxury segment’s strong showing defied the weak showing of the rest of the property market. In the mid-tier segment, non-landed sales volume in the Rest of Central Region (RCR) shrank 18.3% QoQ to 1,196 units in Q1 from 1,464 units in Q4 2019, no thanks to a dearth of new launches and lingering impact of the pandemic.

The average price of resale condos also slipped 1% QoQ from $1,853 psf to $1,834 psf in Q1. Prices of resale non-landed homes also dipped 2.6% over the same period to $1,370 psf from $1,407 psf. However, “[d]espite the price fall, the proportion of non-landed homes by unit size range remained similar to that of the preceding quarter. Last quarter, 532 or 44.4% of non-landed home sales in RCR were below 800 sqft,” noted Sun.

On the mass market segment, the average prices of resale mass market condos stayed steady at $1,042 psf in Q1. However, new non-landed home prices in the Outside Central Region (OCR) fell 4.8% from $1,530 psf in Q4 2019 to $1,459 psf in Q1.

Likewise, sales volume for the mass market’s non-landed homes declined in Q1 on the back of fewer new launches and effects of the pandemic. Around 799 new units were transacted, down 23.5% from the 1,044 units sold in Q4 2019. Resale non-landed homes had also crashed 16% QoQ to 712 units in Q1 from the 848 units in Q4 2019.

The best-selling projects amongst this segment include the Treasure at Tampines, which sold 216 units; whilst Parc Clematis and Parc Botannia moved 93 units and 72 units, respectively. Other projects like The Garden Residences, Whistler Grand, Affinity at Serangoon, Riverfront Residences and The Florence Residences had more than 40 transactions.

Advertise

Advertise