Older flats defy depreciation concerns as sales hit record high in Q1

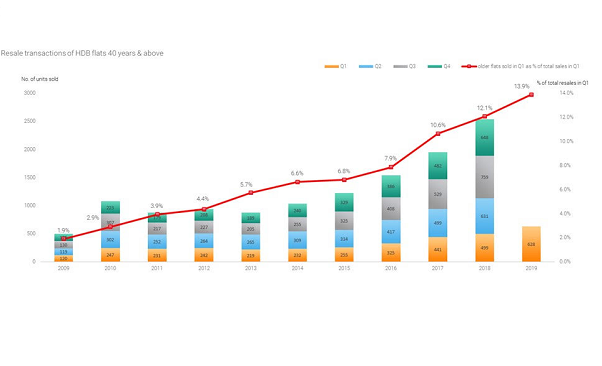

Sales of older flats made up 13.9% of total resale transactions in Q1 2019.

Demand for older flats aged more than 40-years old have defied concerns about their depreciating value and the adverse impact of the cooling measures in July 2018 as a record 2,537 flats were sold in 2018, according to OrangeTee & Tie’s HDB Market Pulse report.

Also read: Old HDB flats weather depreciation better than condos: NUS study

In 2018, older flats sold in the second, third and fourth quarters were all at their highest levels for the respective quarters.

In Q1 2019, 628 older flats were sold, which marks the highest first quarterly sales on record. Sales of older flats can be observed across many towns, with Bedok seeing the highest number of older flats sold at 384 units, followed by Bukit Merah and Toa Payoh with 316 and 315 flats sold, respectively.

The market share of older flats in total resale transactions has also rose from 1.9% in Q1 2009 to 13.9% in Q1 2019, which is said to be the highest percentage ever recorded, OrangeTee & Tie’s managing director Steven Tan noted in the report.

“There could be various factors behind the higher sales of older flats,” Tan explained. “First, the price expectation gap between buyers and sellers could have narrowed as prices of older flats had been moderating over the years. In Q1 2019, the average price of older flats declined about 6% when compared to Q1 2017, and around 7% when compared to Q1 2018.”

Secondly, there could simply be more flats growing older, resulting in more transactions in general. Older flats that are currently transacted tend to be smaller than those with 20- to 40-year leases.

The report pointed out how older four-room standard flats sold in Q1 2019 averaged around 90 sqm, smaller than the 20 to 40-year-old counterparts which averaged around 99 sqm. Similarly, older five-room standard flats were around 119 sqm, smaller than the average 124 sqm for flats with 20- to 40-year leases.

“The smaller older flats translate to lower price quantum and better price affordability for buyers. Some buyers may now view older flats to be of good value for money given their lower price tags,” Tan added.

Also read: CPF loan rules for older HDB resale flats to be relaxed

He also noted that the announcement of the Voluntary Early Redevelopment Scheme (VERS) and Home Improvement Programme (HIP II), and possibly some policy tweaks to allow buyers to use more Central Provident Funds to purchase older flats, may have started to instil some market confidence in older flats.

Overall, demand for Housing and Development Board (HDB) flats remained resilient as the number of HDB resale transactions for Q1 2019 reached a seven-year high with 4,835 flats sold.

.png)

Whilst the number of transactions rose 8.5% YoY, on a quarterly basis, resales declined 14.2%, which was said to be within expectations as the number of resale applications is usually lowest in the first quarter due to slower marketing activities immediately after the year-end holidays and during the Chinese New Year period.

HDB resale prices were found to have declined at a marginally faster pace of 0.3% in Q1, compared to the 0.2% decrease in the previous three-month period.

“Although prices have dipped for a third consecutive quarter, the cumulative decrease over the last nine months is only 0.5%. This is lower than the 0.8% decline seen in Q1 2018, indicating that the resale price of HDB flats may have stabilised,” Tan said.

A five-room build-to-order (BTO) HDB flat at Boon Tiong Road was reportedly sold for a record $1.2m in April 2019, which is the first time that the price of a standard HDB flat has surpassed the priciest non-standard flats ever sold. It smashed the previous records set by a 237-sqm HDB Terrace at Jalan Bahagia sold in September 2018, as well as a five-room DBSS at Boon Keng Road in January 2019. Both of which sold for $1.85m.

“We anticipate that HDB resale volume may rise in tandem with more flats reaching their five-year Minimum Occupation Period (MOP) this year. However, we anticipate that the number of flats sold at higher price quantum may increase as around 3,500 flats built under the DBSS and almost 4,000 flats in mature estates like Bukit Merah, Queenstown and Ang Mo Kio will be reaching MOP,” Tan commented.

With the increasing supply of completed flats, prices may flatline or fall marginally by 1% to 2% in 2019.

Advertise

Advertise