Secondary property sellers pressured to slash asking prices: report

NUS’ index recorded a 25.03% QoQ drop secondary sales even as prices eased 0.5%.

Sellers in the secondary market are feeling under greater pressure to lower their asking prices due to slowing sales in Q1 2019, according to a report by Knight Frank.

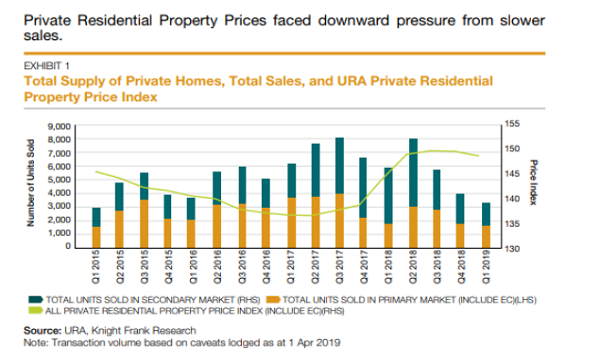

The private residential property index slipped 0.6% QoQ or 0.9 point from 149.6 points in Q4 2018 to 148.7 points in Q1 2019, according to the Urban Redevelopment Authority’s (URA) flash estimates of the price index for private residential property for Q1 2019.

“The prices of new projects were holding up in Q1, and the decline in URA price indices was more reflective of the prices of completed properties transacted in the secondary market in Q1,” Lee Nai Jia, senior director and head of research at Knight Frank Singapore, and Lucy Zhu, Knight Frank’s research analyst, said in the report.

Meanwhile, the NUS Singapore Residential Price Index, which tracks the prices of completed non-landed private homes and a proxy for the secondary market, eased by 0.5% MoM after January’s 0.2% dip in price. Secondary sale transactions in Q1 2019 dropped to 1,623 units from 2,165 units in Q4 2018, the report noted.

“Whilst not all the properties transacted Q1 2019 were recorded yet, it was unlikely the secondary sale transaction volume would exceed the 2,165 units transacted in Q4 2018,” Lee and Zhu explained. In contrast, new sales declined more moderately than the secondary sales, retreating by 7.4% QoQ to 1,681 units in Q1 2019.

The prices of non-landed properties in Core Central Region (CCR) were expected to be more resilient than prices of those outside CCR, but were seen to decline by 2.9% QoQ, whilst the price index for non-landed properties Outside Central Region (OCR) stayed flat. The price index for non-landed properties in the Rest of Central Region (RCR) also stayed largely unchanged, dipping marginally by 0.2% QoQ.

Lee and Zhu further added that the announcement of the Cross-Island Line could have supported the prices of non-landed properties in OCR and RCR in Q1. “In contrast, the fall in price index of non-residential properties in CCR probably emanated from the secondary market where individual owners were seeking to divest their properties urgently,” they said.

Out of the new projects that were in the market in Q1, Treasure at Tampines sold the most with 270 units at an average unit price of $1,339 per sqft. Separately, the announcement of the upcoming stations of the Cross-Island line boosted sales of developments that were in proximity to the upcoming stations, such as Affinity at Serangoon and Riverfront Residences.

“According to the top five selling projects, most of the buyers were acquiring units that have a floor area between 500 and 800 sqft for less than $1.1m,” Lee and Zhu said, adding that the residential status of the buyers of the top five projects were mainly Singaporeans. “Given that these projects were not within the CCR, they were less attractive to foreign buyers who had to fork out higher Additional Buyer’s Stamp Duties (ABSD).”

Separately, the rental markets stayed largely stable across all segments, although the average rent for ultra-luxury properties came down QoQ in Q1 2019 which was attributed to seasonality effects.

“We project sales to remain moderate for the rest of 2019 due to the growing mismatch of price expectations between buyers and sellers. Notwithstanding, the recent announcement of the Draft Master Plan 2019 may encourage more sales in areas that are earmarked for future development,” they highlighted.

Lee and Zhu further noted that the property price index for non-landed properties in CCR is likely to improve or stabilise after the announcement the initiatives to rejuvenate the CBD and Orchard Road, and the development of the Greater Southern Waterfront.

Advertise

Advertise