Photo from Savills

Photo from Savills

Why Singapore rents are falling

In H1 2024, rents fell by 4.5% HoH and 5.6% YoY.

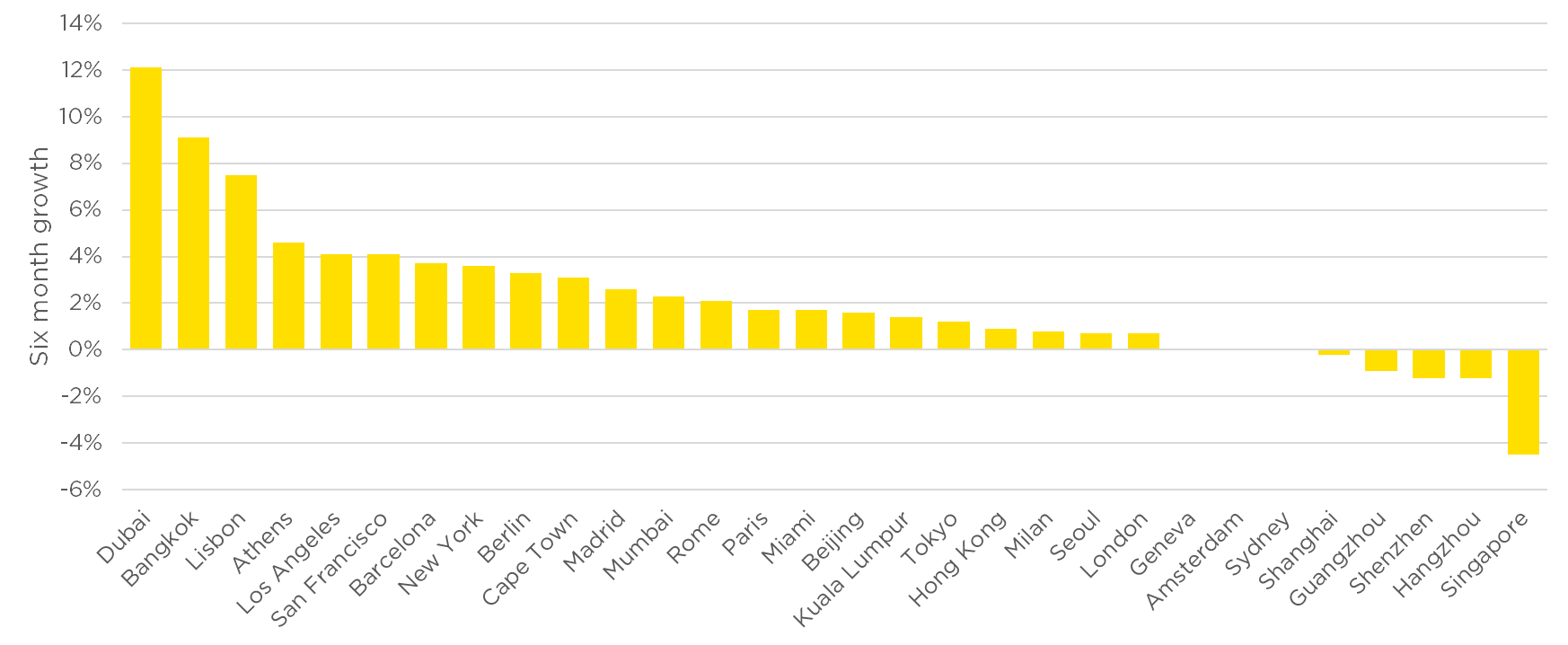

Singapore has fallen to the bottom of the rankings of cities with the biggest prime rental value changes, and experts attribute this to rents in Singapore being "out of sync with global trends."

"Starting in 2022, when markets around the world saw rents continue to decline, Singapore experienced a very sharp run-up in prices. In 2024, rents are now correcting in an orderly fashion as more supply comes online," said Alan Cheong, executive director of Research & Consultancy at Savills Singapore.

According to Savills Prime Residential Index: World Cities – Rents and Yields, Singapore's rents have fallen by 4.5% HoH and 5.6% YoY, placing it at the lowest position in the index.

The report also attributed the decline to the slowdown in leasing demand in the prime districts and a moderation in economic growth and employment expansion.

Cheong believes that Singapore "may see the rental market starting to stabilise by the end of the year as the quarter-on-quarter rental decline appears to be slowing."

Globally, the cities which recorded the biggest prime rental value changes were Dubai (12.1%), Bangkok (9%) and Lisbon (7.5%).

In a separate report, Savills revealed that Singapore has fallen in the rankings of cities with the biggest capital value growth for residential properties.

Savills, however, underscored that Singaproe's decline is negligible, as prices have remained largely unchanged.

Advertise

Advertise