Asian property developers cut borrowing to fund projects

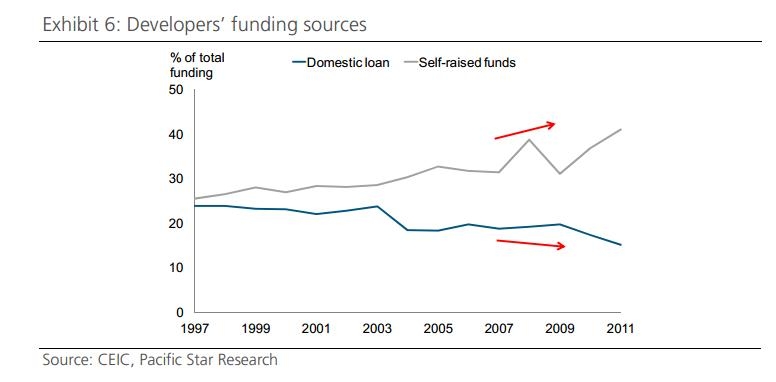

Domestic loans as a share of total source of fund stood at 15% in 2011, down from 24% in 1997.

According to Pacific Star, following a lending binge of more than RMB 4tn in 2009-10 in the real estate sector, banks have been much more stringent in making property loans. However, the evidence suggests that property developers have not been denied financing more severely than households.

"For instance, outstanding loans to property developers, as a share of total outstanding loans to the real estate sector stood at a constant 25% for the past several quarters. Structurally, the reliance by developers on bank loans has declined in general (Exhibit 6). Domestic loans as a share of total source of fund stood at 15% at the end of 2011, down from 24% in 1997. On the other hand, developers saw an increase in the share of self-raised funds from 25% in 1997 to 41% in 2011," it said.

Here's more from Pacific Star:

While several bankruptcy filings of developers have made the headlines, these are relatively small players when compared to the listed developers. The risk of bankruptcy is significantly lower for the group of listed developers who are likely to have access to alternative means of financing.

Developers are seeking alternative sources of revenues by setting up property funds or selling commercial assets in key cities like Shanghai and Beijing to raise cash for their housing projects. The recent relaxation of mortgage borrowing for first-time homebuyers will also aid the cash flow for developers.

Advertise

Advertise