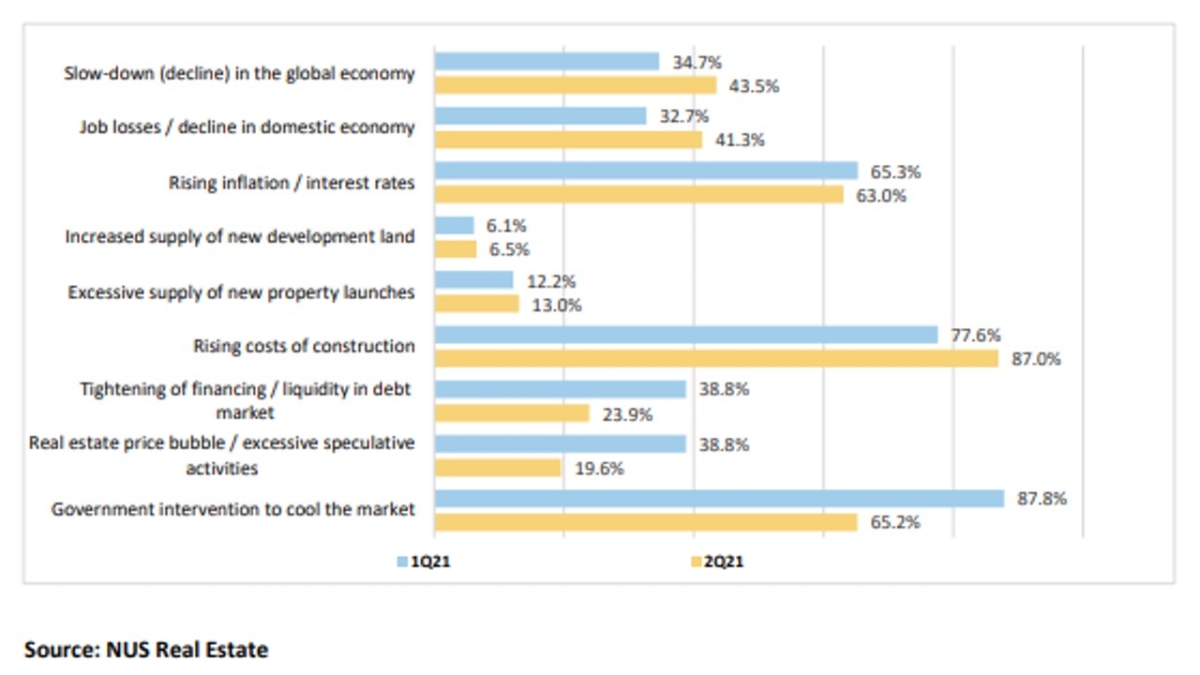

Chart of the Day: 87% of real estate execs point towards rising constructions costs as potential red flag

Potential risks include rising costs of construction, inflation, and interest rates that can lead to a negative impact on market sentiment.

This chart from the National University of Singapore and the Institute of Real Estate & Urban Studies shows the potential factors that could lead to a further drop in the Current Sentiment Index (CSI), an indicator that highlights the expectations of the market.

87% of their respondents looked toward costs of construction as a potential factor in affecting the CSI, while 63% pointed towards inflation and rising interest rates as another game-changer. These respondents include executives of real estate firms.

The CSI is published as part of the Real Estate Sentiment Index, which aims to be an alternate measure of private real estate market performance.

Based on their study, the CSI currently stands at 6.6% for the second quarter of 2021, down from 6.9% in the first quarter.

Advertise

Advertise