Chart of the Day: Here’s solid proof that the current property price downturn is still incredibly mild

Price drops were drastic in past crises.

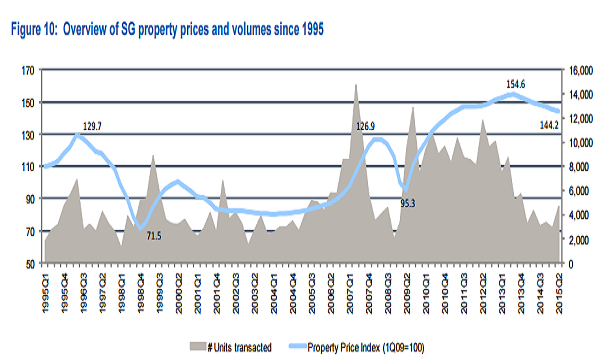

Singapore’s property price index has been falling steadily for the past eight quarters, but analysts from RHB Research argue that the current market downturn is still substantially mild compared to past price downtrends.

Private property prices have declined by some 7% from its peak in mid-2013. This is a far cry from steep price drops seen during the past two down cycles, which occurred during the Asian Financial Crists (AFC) in 1997-1998 and the Global Financial Crisis (GFC) in 2008.

In the last 18 years, the Singapore property market has gone through two severe down cycles. Once in 1997-1998 during the AFC when property prices crashed by almost half from the 1996 peak and, more recently, during the 2008 GFC when prices sank by as much as 25%.

During the AFC, prices crashed by almost half from the 1996 peak despite the Government’s intervention. The Urban Redevelopment Authority (URA) property price index dropped from its peak of 129.7 in Q2 1996 to 71.5 in Q4 1998.

During the GFC, meanwhile, the URA property price index crashed 24.9% from 126.9 to 95.3 in just four quarters.

After the short-lived price contraction during the GFC, property prices soared by 62% on the back of pent-up demand and a supply bottleneck in the public housing market, coupled with a low interest-rate environment.

Advertise

Advertise