Chart of the Day: Investment sales down

Contraction was both quarterly and annually.

Savills Research reported:

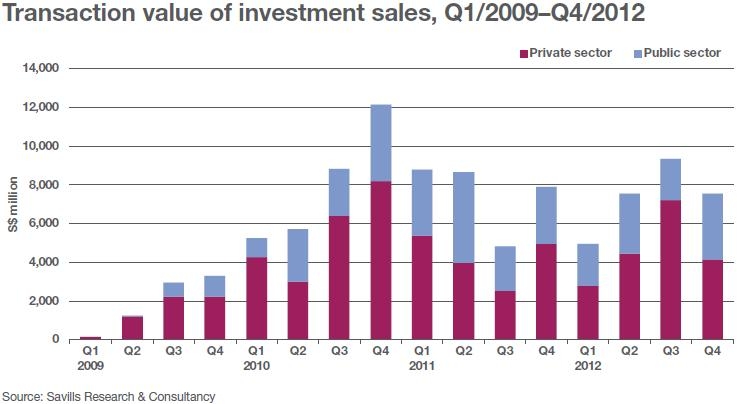

In Q4/2012, investment sales across all property types totalled about S$7.6 billion, bringing the whole year’s number to S$29.4 billion, a shade below the S$30.1 billion recorded last year and the S$32.0 billion in 2010.

On a quarterly basis, Q4’s investment sales contracted by about 19% from the S$9.3 billion recorded in the previous quarter.

The decline was mostly attributed to the private sector, where transaction values declined 43% from a quarter ago. Except for offices, the other segments recorded quarterly drops in transaction value ranging from 69% to 90%.

The weak global economy and a still wide bid-ask gap remained the key reasons behind the tepid investment activity in the private sector. The year-end festive season has also lengthened the negotiation and decision-making processes.

On the other hand, local and even foreign developers, in an effort to replenish their land banks, continued to contest aggressively in the tenders of state land launched under the Government Land Sales (GLS) programme.

Furthermore, riding on the current buoyant sales market of executive condominiums (EC), strata offices, shops and medical suites, some sites slated for such uses received record-high prices.

In the reviewed quarter, the public sector saw 22 state land parcels1 sold for a total of about S$3.4 billion, accounting for 45% of Q4’s total investment sales. This was a sharp increase of 59% from the S$2.2 billion recorded in the previous quarter.

For the whole of 2012, private sector transaction values have increased 10% from S$16.9 billion in 2011, to S$18.5 billion, while the public sector achieved S$10.9 billion, falling 18% from S$13.3 billion a year ago.

Advertise

Advertise