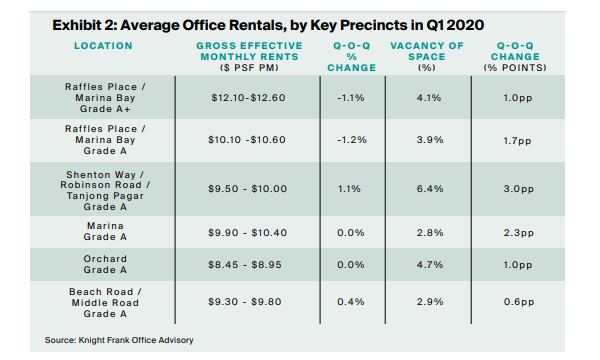

Chart of the Day: Prime grade office rents down 1.1% in Q1

Occupancy rates at new office completions remained muted at below 35%.

This chart from Knight Frank shows that prime grade rents dropped by 1.1% QoQ in Q1 2020, as occupancy rates for prime grade offices in Raffles Place/Marina Bay declined by 0.6 percentage points (ppt) QoQ to about 96%.

In addition, occupancy rates at new office completions remained muted at below 35% in 30 Raffles Place, whilst 55 Market Street is still in discussions with prospects. Both buildings obtained their Temporary Occupation Permit (TOP) in Q1.

Meanwhile, of some 220,000 sqft of space to be vacated by UBS in ORQ North Tower come Q4, about 85% has yet to be committed, pointing to a slowing takeup rate. With business disruptions and an uncertain economic outlook, prime rents are expected to fall by around 5%-10% for the year.

Demand and rents are starting to come under pressure as companies delay expansion and relocation plans amidst the COVID-19 crisis. Whilst net absorption of private sector office space in the Central Business District (CBD) increased to some 840,000 square feet (sqft) in Q1, the rise was due to major leasing deals that were committed pre-COVID 19.

"The decline in prime grade office rents in Q1 2020 was moderated by high occupancy rates of above 90%. Nevertheless, there will be increasing pressure on occupancy and rents for the rest of the year resulting from the crisis," the report added.

Advertise

Advertise