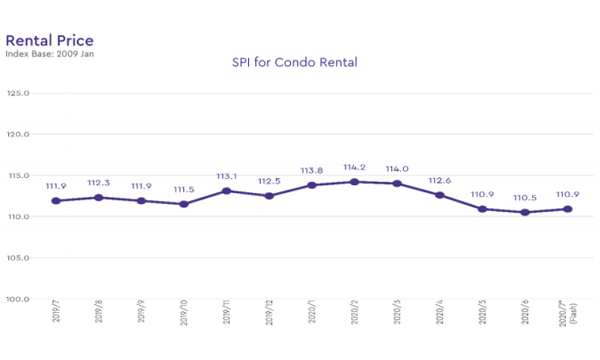

Condo rents slipped 0.9% in July

Rents in the CCR and OCR fell.

Overall condo rents in July dipped 0.9% YoY, albeit a 0.4% increase on a MoM basis, according to SRX.

Rents in the Core Central Region (CCR) and the Rest of Central Region (RCR) fell by 1.8% YoY and 1.9% YoY respectively, whilst rents in the Outside Central Region (OCR) rents inched up 0.4% YoY.

Meanwhile, condo rental volumes crashed 32.3% YoY and 7.2% MoM to around 3,880 units in July, as compared to 4,183 units in June. Volumes are 22.8% lower than the five-year average volume in the same month.

Breaking down by regions, 39.2% of the total volume came from OCR, 33.7% from RCR and 27.1% from CCR.

As for the HDB rental market, rents dipped 0.5% YoY and 1.4% MoM. Mature estates rents dropped 1.7% YoY, whilst non-mature estates rents edged up 0.8% YoY.

Rents for three-room, five-room and executive flats posted declines of 1.1%, 0.9% and 2.4% YoY respectively, whilst four-room rents rose 0.5% YoY.

For both condo and HDB’s MoM rental increase, OrangeTee & Tie’s head of research and consultancy Christine Sun some landlords could have raised their asking rents after observing a sudden surge in demand during the Circuit Breaker period with many tenants renewing their leases in recent months.

“There could be more expats opting for more modest housing options in the RCR and OCR during the current economic slowdown. Therefore the shift in demand may have caused rents to be raised in these two regions. Conversely, rents for more luxurious homes in the CCR were under greater downward pressure, which is reflected in the five consecutive dips in the monthly rents,” she added.

Volumes also crashed 31.6% YoY and 19.1% MoM to an estimated 1,435 HDB flats in July. Volumes are also 25.7% lower than the five-year average volume.

Three-room flats account for 36.5% of the total volume, 35.8% from four-room, 23% from five-room and 4.8% from executive.

“The rental volumes are considered low as this is the typical rental season when we will usually see higher rental volumes compared to other months. Therefore, the rental markets may be experiencing some early impact from the macroeconomic slowdown and ill-effects of the pandemic,” Sun commented.

“We may expect more tenants to continue to opt for cheaper housing options as some may be facing pay cuts or given smaller housing packages in the current macroeconomic uncertainties.”

Advertise

Advertise