Condo resale volume rise to two-year high in August

Investors may be flocking to properties in their search for stable returns, analyst said.

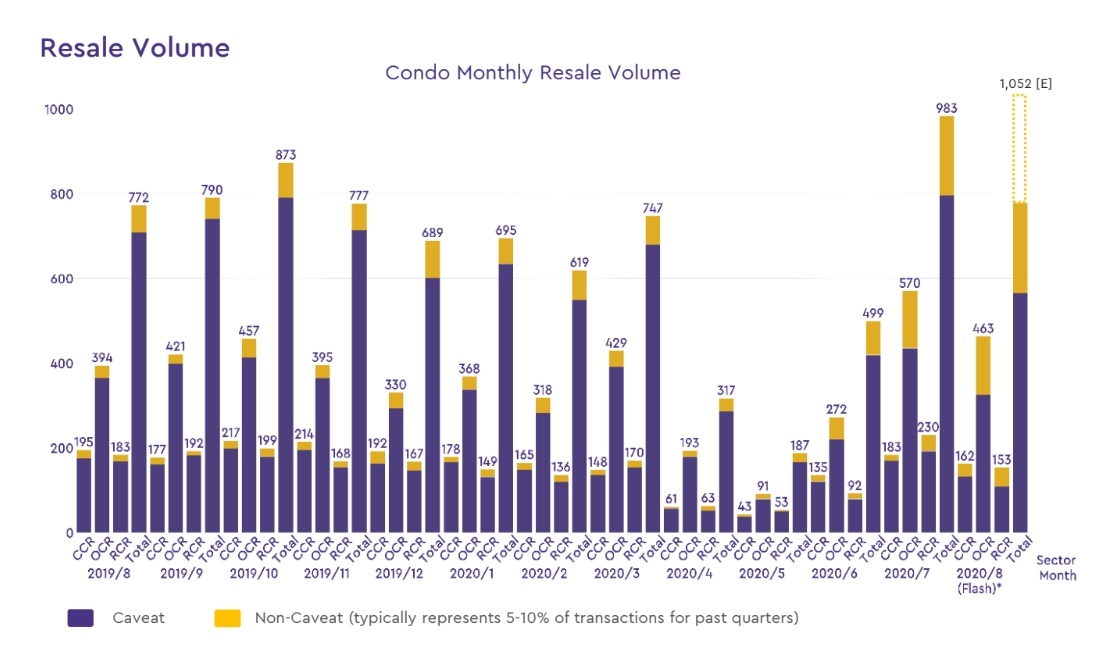

Condo resale volumes rose to its highest since August 2018, with 1,052 units resold last month, according to the latest SRX Media Flash Report. The figure is also 7% higher compared to July.

Meanwhile, condo resale prices rose moderately to 0.4% in August compared to a year earlier and is also 0.4% higher than in July.

This may indicate early signs of recovery for Singapore’s residential market—or may be driven by investors looking for stable returns, especially amidst the ongoing economic uncertainty, noted Christine Sun, OrangeTee & Tie’s head of research and consultancy.

“For many Singaporeans, residential properties may still be a 'safer bet' especially for investors who are looking for stable returns during times of uncertainty. The market exuberance from the primary market may have also spread to the secondary market as opportunistic buyers are currently on the look-out for under-valued resale properties in the market,” Sun said.

Of the record-breaking resale volumes, 59.5% came from OCR, 20.8% from CCR and 19.7% from RCR.

OCR resale prices also jumped 2.8% in August compared to a year earlier, whilst CCR and RCR resale prices fell by 3.1% and 1.7%, respectively.

The highest transacted price for a resale unit in the month is achieved at $8.4m at Hilltops.

In RCR, the highest transacted price is a unit at Reflections at Amber Skye, which was resold for $5.1m; whilst the highest transacted price for a unit in OCR was a unit at Grand Duchess at Saint Patrick’s, which was resold for $3.6m.

Propnex Realty’s Siew Ying Wong expects total condo resale volume to reach 7,500 to 8,000 units in 2020. This is lower than 8,949 units resold in 2019 but is still very a respectable number in view of the massive disruption from the pandemic, he said.

Meanwhile, he expects resale prices to be relatively flat in the coming months, given the gloomy economic prospects as well as muted sentiment, which will weigh on sellers’ ability to raise asking prices substantially.

“In addition, buyers are likely to be cautious and prudent in their purchase, mindful of potential downside risks ahead, including the weaker hiring market,” he concluded.

Advertise

Advertise