Condo sales pick up in Q3 as circuit breaker eases

New sale volumes to reach 8,000-9,000 in 2020.

Singapore’s non-landed residential market sales registered a “gravity-defying” rebound in Q3 despite the year being fraught with the pandemic and what will most likely be Singapore’s worst recession, reports Knight Frank.

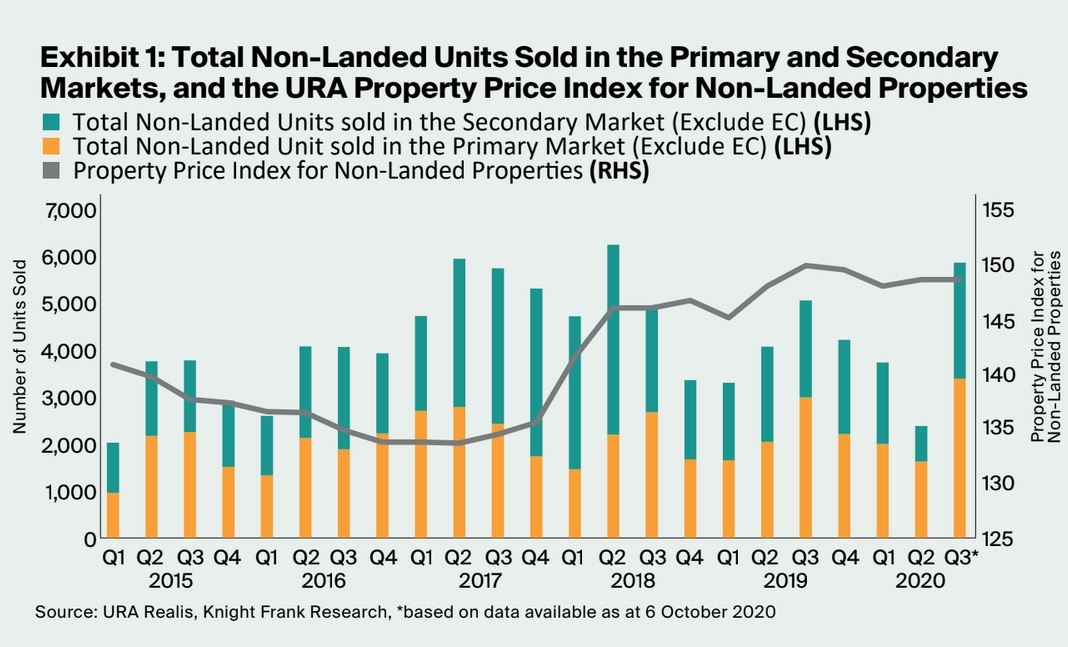

Transaction volumes of non-landed residential properties (excluding executive condominiums) more than doubled from the previous quarter, recording 5,895 units during the past quarter.

Pent-up demand from buyers who deferred their purchases coupled with low interest-rates drove sales momentum. In particular, those with needs-based buyers and those who feared that prices might increase in the near-term may have helped drum up sales, the report added.

A significant number of the almost 50,000 HDB homeowners who collected their keys in 2014 and 2015 were also able to capitalize their gains and upgrade to the private market after fulfilling the five-year Minimum Occupation Period (MOP).

Overall, new sale volumes are forecasted to reach about 8,000 to 9,000 units as Singapore moves towards Phase 3 of the Circuit Breaker (CB). Prices are also expected to remain largely flat for the whole of 2020.

The resale market also rebounded in Q3 on the heels of the new sale market. A total of 2,480 units were transacted in the secondary market, more than three times the 758 resale units sold in Q2.

“More resale transactions were completed as in-person viewings resumed in Phase 2 and owners grew more confident in allowing viewings with falling COVID-19 cases,” said Linda Chen, Leonard Tay, and Khoo Zi Ting of Knight Frank.

On the other hand, the Core Central Region (CCR) registered a price drop, with the PPI for non-landed private homes declining by 4.9% QoQ to 128. Meanwhile, non-landed prices in Rest of Central Region (RCR) picked up 3.3% QoQ to 155.

With most of the new project launches in Q3 located in the RCR, new sale volumes saw the biggest jump at 177% QoQ as compared to the CCR and Outside the Central Region (OCR), recording 1,797 transactions. New sales were bolstered by projects such as Forett @ Bukit Timah and Penrose which sold some 30% and 60% of their total units respectively during their launch weekend, attesting to the pent-up demand post-circuit breaker.

Meanwhile, non-landed prices inched up by 1.7% QoQ in OCR.

Advertise

Advertise